As the curtain closes on 2025, The Walt Disney Company (NYSE: DIS) finds itself at a defining crossroads, balancing significant regulatory challenges with a massive capital expenditure program designed to solidify its dominance for the next decade. On December 30, 2025, the U.S. Department of Justice (DOJ) announced that Disney has agreed to pay a $10 million civil penalty and accept a permanent injunction to settle allegations of violating the Children’s Online Privacy Protection Act (COPPA). The settlement stems from claims that Disney failed to properly label its children’s content on YouTube, leading to the unlawful collection of data from minors under 13 for targeted advertising purposes.

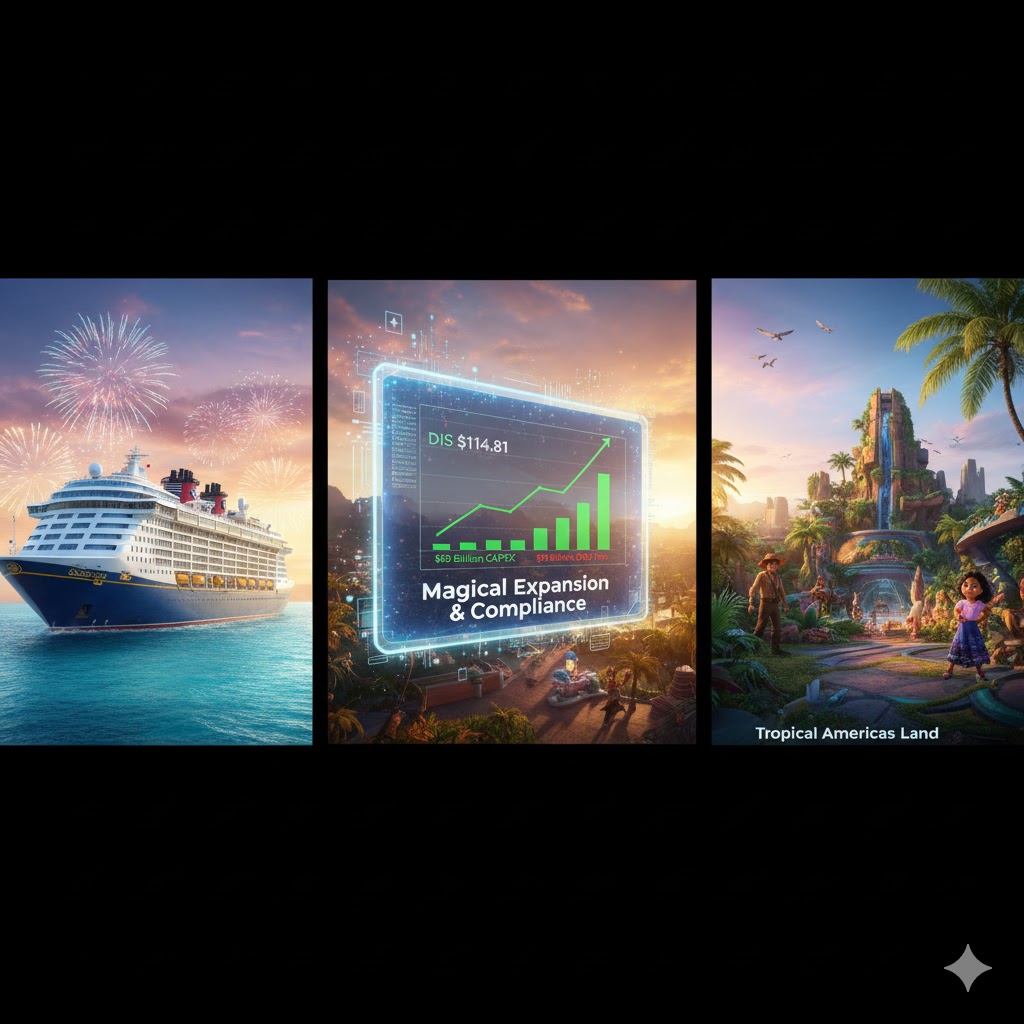

Despite this regulatory friction, Disney’s stock demonstrated typical blue-chip resilience. On the final trading days of the year, DIS closed at $114.81, reflecting a daily gain of 0.54% and a weekly climb of approximately 2.65%. With a market capitalization now exceeding $205 billion, the company is aggressively pivoting its business model, moving past the “streaming wars” of the early 2020s into a new era defined by “Sovereign Experiences” and AI-integrated storytelling. This report analyzes the fundamental shifts within the House of Mouse as it prepares for a transformative fiscal 2026.

Financial Vitality: Transitioning to Sustained Profitability

Disney’s fiscal year 2025 results, reported in November, revealed a company successfully “turning the corner.” Total annual revenue reached $94.4 billion, a 3% increase year-over-year, while income before taxes surged to $12.0 billion, up from $7.6 billion in fiscal 2024. Most impressively, Disney’s Diluted Earnings Per Share (EPS) for the full year hit $6.85, a massive jump from the $2.72 reported in the previous year.

The company’s “fortress balance sheet” strategy is now paying dividends. Management has doubled its share repurchase target to $7 billion for fiscal 2026 and expects double-digit adjusted EPS growth through 2027. This financial health is underpinned by the successful turnaround of the Direct-to-Consumer (DTC) segment, which reported an operating income of $1.3 billion for the full year 2025. This marks a historic pivot from the $4 billion annual losses the streaming division incurred just three years ago. The $10 million COPPA fine, while significant as a regulatory signal, represents less than 0.1% of the company’s annual net income, suggesting that while the reputational risk is real, the financial impact is negligible in the context of Disney’s broader cash flow.

The Experiences Engine: A $60 Billion Bet on Physical Reality

The most robust segment of Disney’s business remains “Experiences,” which includes its world-class theme parks, resorts, and cruise lines. In fiscal 2025, this segment delivered record operating income of $10 billion, an 8% increase over the previous record set in 2024. Notably, international parks surged 25%, led by a stellar performance at Disneyland Paris and the continued expansion of Zootopia-themed lands in Asia.

To maintain this momentum, CEO Bob Iger has committed to a $60 billion capital expenditure plan over the next ten years. This is not merely about maintenance; it is a strategic expansion of capacity. In late 2025, Disney took delivery of its largest ship ever, the Disney Adventure, and launched the Disney Destiny, a “heroes and villains” themed vessel that further integrates Marvel and Pixar IP into the cruise experience. On land, 2025 saw the permanent closure of several older attractions at Animal Kingdom and Hollywood Studios to make way for massive new lands: a Tropical Americas land (scheduled for 2027) and a reimagined Walt Disney Studios area. By investing in capacity, Disney is addressing the “crowd problem” while simultaneously justifying premium pricing strategies like the evolved Lightning Lane Premier Pass.

Streaming Maturity and the Sora Frontier

Disney’s streaming strategy reached a state of “operational maturity” in late 2025. The company ended the year with 196 million combined Disney+ and Hulu subscriptions, adding 12.4 million in the final quarter alone. The integration of Hulu content into the primary Disney+ app is nearly complete, with plans to fully sunset the standalone Hulu app by early 2026. This consolidation is expected to drive 10% operating margins for the DTC segment in the coming year.

A major catalyst for Disney’s future product development is the landmark agreement reached with OpenAI in December 2025. This partnership allows Disney to bring its beloved characters into the Sora ecosystem, enabling highly sophisticated, AI-generated video content for marketing and interactive park experiences. This move validates the immense value of Disney’s intellectual property (IP) in an AI-driven world. While the DOJ’s COPPA settlement highlights the risks of data collection in digital spaces, the OpenAI partnership shows that Disney is leaning into technology to lower content production costs and increase engagement across its “flywheel.”

Market Expansion: The JioStar Powerhouse in India

One of the most significant strategic events of 2025 was the completion of the $8.5 billion merger with Reliance Industries in India. This created JioStar, a media behemoth with over 100 TV channels and a dominant 40% market share in linear TV and streaming in the world’s most populous nation. Although Disney’s stake in the joint venture is 36.84%, the deal effectively derisks Disney’s exposure to the volatile Indian market while maintaining a significant claim on the country’s sports and entertainment ad revenue.

In the domestic theatrical market, Disney’s “Winter 2025” slate is anchored by high-conviction sequels: Zootopia 2 and Avatar: Fire and Ash. These films are expected to serve as massive funnels for the theme parks, reinforcing the virtuous cycle of IP monetization. Looking ahead to 2026, the theatrical schedule is arguably the strongest in a decade, featuring The Mandalorian and Grogu, Toy Story 5, and a live-action Moana.

Conclusion: Managing the Regulatory and Creative Balance

The $10 million settlement with the DOJ serves as a reminder that as Disney grows its digital footprint, it remains under a microscopic regulatory lens, particularly regarding the safety of its youngest fans. However, the company’s fundamental business units—Streaming, Experiences, and Content—are more synchronized now than at any point since the 2019 Fox acquisition.

With a massive $60 billion investment in physical experiences, a now-profitable streaming business, and a dominant joint venture in India, Disney is entering 2026 as a leaner, more technologically advanced version of itself. While macroeconomic headwinds and shifting consumer travel patterns remain risks, Disney’s ability to generate $19 billion in cash provided by operations (projected for FY2026) provides it with a unique ability to out-invest its competitors. For those analyzing the entertainment landscape, the story of Disney in late 2025 is one of a legacy giant successfully navigating its transition into a digital-first, experience-heavy global powerhouse.

Leave a Reply