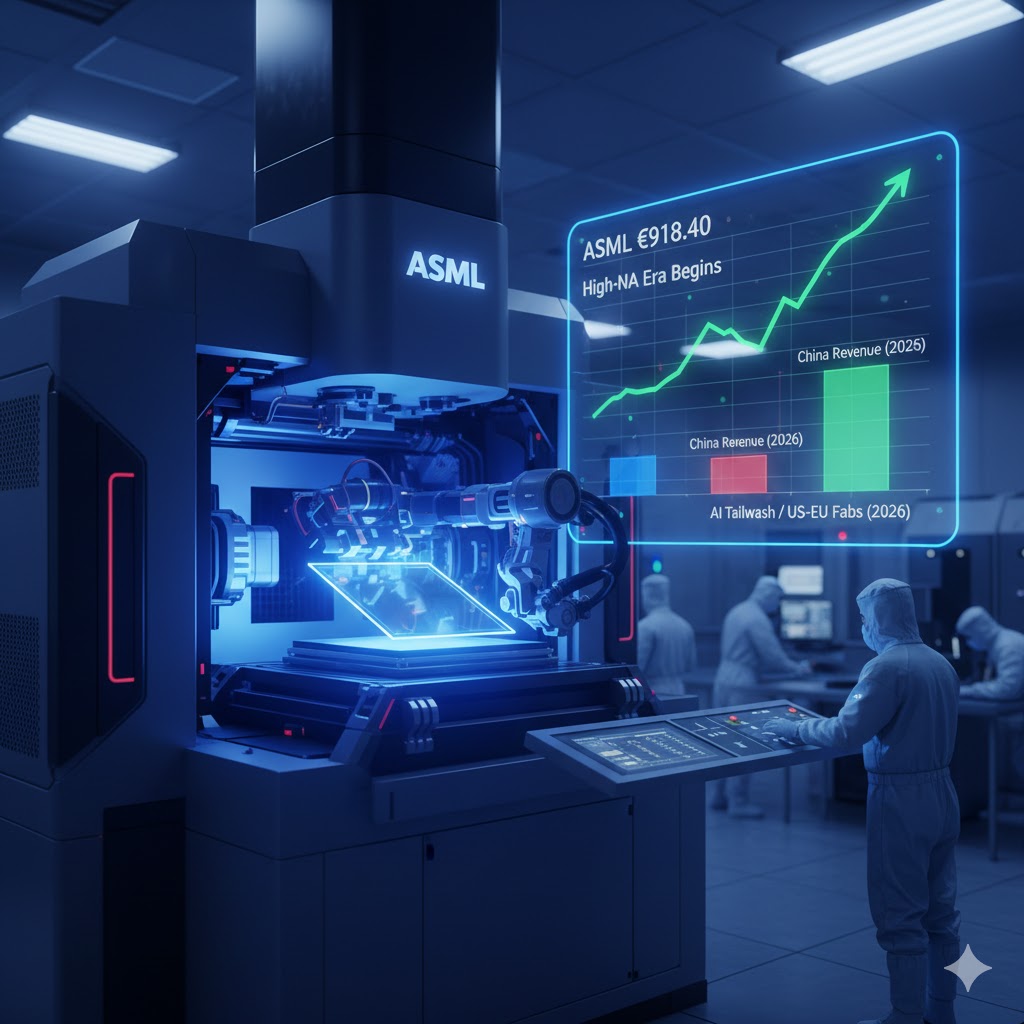

The global semiconductor landscape reached a critical juncture in the final trading days of 2025. On December 30, the Philadelphia Semiconductor Index (SOX) witnessed a significant broad-based surge as investors recalibrated their portfolios for a year defined by artificial intelligence infrastructure and the transition to sub-2nm process nodes. At the center of this rally were the industry’s heavyweights: Intel (INTC) jumped over 4%, Marvell Technology (MRVL) rose over 2%, while Micron Technology (MU) and NVIDIA (NVDA) followed suit with strong gains. Crucially, ASML Holding NV (ASML), the sole provider of the world’s most advanced lithography systems, mirrored this upward momentum, closing at €918.40 ($967.73) with a daily gain of approximately 1.28%.

As of late December 2025, ASML’s market capitalization stands at a formidable €416.7 billion (approximately $440 billion), reflecting its status as the “bottleneck” of the global tech economy. Without ASML’s Extreme Ultraviolet (EUV) machines, the AI revolution—and the hardware that fuels it—simply ceases to exist. This report provides a detailed, data-driven analysis of ASML’s financial health, its strategic pivot toward High-NA EUV, and the geopolitical complexities that will define its 2026 trajectory.

Financial Vitality: Analyzing the 2025 “Transition Year” Results

To understand ASML’s current position, one must look at its fiscal 2025 performance, which the company famously labeled a “transition year” in preparation for a massive 2026. According to the company’s Q3 2025 financial disclosures, net sales reached €7.5 billion, with a gross margin of 51.6%. While the quarterly revenue was slightly below some aggressive analyst forecasts, the €2.1 billion net income and the €5.4 billion in net bookings (of which €3.6 billion was for high-end EUV systems) signaled a robust underlying demand for advanced manufacturing capacity.

For the full year 2025, ASML’s management reaffirmed an outlook of approximately 15% total net sales growth compared to 2024, aiming for a total revenue range between €32.5 billion and €33.5 billion. The company’s efficiency is underscored by its 35.2x P/E ratio, which, while premium, is justified by its 100% market share in the EUV segment and a 97% profitability score relative to the broader industrial sector.

One of the most significant financial shifts in 2025 was the surge in Installed Base Management (IBM) revenue, which averaged roughly €2 billion per quarter. As the global fleet of ASML machines grows, the high-margin service and upgrade business provides a “cushion” of recurring revenue that mitigates the cyclicality of new system sales. As of December 30, ASML has also returned significant capital to shareholders, having acquired 9 million shares for €5.9 billion under its current buyback program, with a new multi-billion euro program expected to be announced in January 2026.

The High-NA Revolution: EXE:5000 and the Path to 2nm

The technological heart of ASML’s future is the High-Numerical Aperture (High-NA) EUV system. In late December 2025, a historic milestone was reached when Intel Corporation announced the successful qualification and acceptance testing of the industry’s first commercial High-NA tool (the EXE:5000). This machine, which costs approximately $350 million to $400 million, is essential for manufacturing chips at the 2nm node and beyond.

The shift from standard EUV (0.33 NA) to High-NA (0.55 NA) facilitates a 2.8x increase in feature density. For chipmakers like TSMC, Samsung, and Intel, this means they can achieve finer patterns in a single exposure, rather than resorting to complex and costly “multi-patterning.” By reducing the number of process steps, High-NA systems ultimately lower defect density and shorten manufacturing cycle times—factors that are critical as AI companies demand millions of increasingly complex Blackwell-class and Rubin-class GPUs.

ASML’s roadmap suggests that while 2025 was the year of “installation and learning,” 2026 will be the year of High-Volume Manufacturing (HVM). The company expects to recognize revenue from several more High-NA systems in the coming year, which will significantly lift gross margins toward the company’s 2030 target of 56% to 60%. The backlog of orders for these machines is currently estimated to extend into 2028, providing ASML with unprecedented visibility into its future revenue streams.

Market Dynamics: The China Headwind and the AI Tailwash

A critical component of ASML’s 2026 outlook is the “China Factor.” Throughout 2024 and early 2025, Chinese semiconductor firms engaged in an aggressive “stockpiling” of Deep Ultraviolet (DUV) lithography systems, anticipating stricter export controls. This led to China accounting for as much as 42% of ASML’s revenue in certain quarters of 2025.

However, management has issued a stark warning: China’s demand is expected to “decline significantly” in 2026. This is due to both the natural saturation of the Chinese trailing-edge market and the tightening of Dutch and U.S. export restrictions. Analysts project that revenue from China could drop to approximately 20% of total sales by late 2026.

Despite this localized slowdown, the “AI Tailwash” is expected to more than compensate for the loss. The global semiconductor industry is projected to reach $975.4 billion in revenue in 2026, a 26% jump from 2025 levels. This growth is being driven by a $2.8 trillion surge in AI-related capital expenditure through 2029.

As hyperscalers like Microsoft, Meta, and Alphabet continue to build out “AI Factories,” the demand for high-performance HBM3E (High Bandwidth Memory) and advanced logic chips is exploding. Samsung and SK Hynix, in particular, are expected to significantly ramp up their EUV tool orders in 2026 to keep pace with the memory requirements of next-generation AI processors.

Strategic Infrastructure and Geopolitical Positioning

ASML does not operate in a vacuum; it is a central player in the “Chip War” geopolitics. The company has strategically diversified its manufacturing and R&D footprint, with significant expansions in Veldhoven (The Netherlands), Connecticut (USA), and Taiwan. This “regional investment” strategy aligns with the “CHIPS Act” initiatives in the U.S. and Europe, where governments are subsidizing the construction of massive new fabs.

In Q4 2025, ASML’s guidance for revenue between €9.2 billion and €9.8 billion suggests a very strong end to the year, likely driven by the fulfillment of EUV orders for new fabs in Arizona and Ohio. The company is also deepening its AI software capabilities through partnerships, such as its collaboration with Mistral AI, to integrate machine learning into its “Computational Lithography” suite—software that helps chipmakers predict and correct for optical distortions before the first wafer is even printed.

Furthermore, the company’s Installed Base Management is evolving. ASML is increasingly moving toward “Service-as-a-Platform,” using AI to monitor the health of its global fleet in real-time. This reduces downtime for customers and creates a higher-margin, stickier relationship that is less dependent on the macro-economic cycle of new machine sales.

Conclusion: The 2030 Vision and Beyond

Looking toward the end of the decade, ASML has provided an “aspirational” 2030 target of €44 billion to €60 billion in annual revenue. To reach the high end of that range, the company will need to successfully transition the industry to Hyper-NA EUV, the next-generation lithography technology currently in early research phases.

As of December 31, 2025, the data suggests that ASML remains the most critical “toll-booth” in the global technology ecosystem. While 2026 will be a “Transition Year 2.0″—as the company navigates the normalization of the Chinese market—the fundamental shift toward AI-centric computing is providing a secular tailwind that is unprecedented in the history of the semiconductor industry.

The successful deployment of High-NA tools at Intel and the robust order backlog from TSMC and Samsung indicate that ASML’s technological moat is not only intact but widening. For those analyzing the semiconductor sector, ASML represents the ultimate proxy for the health of Moore’s Law and the scalability of the artificial intelligence era.