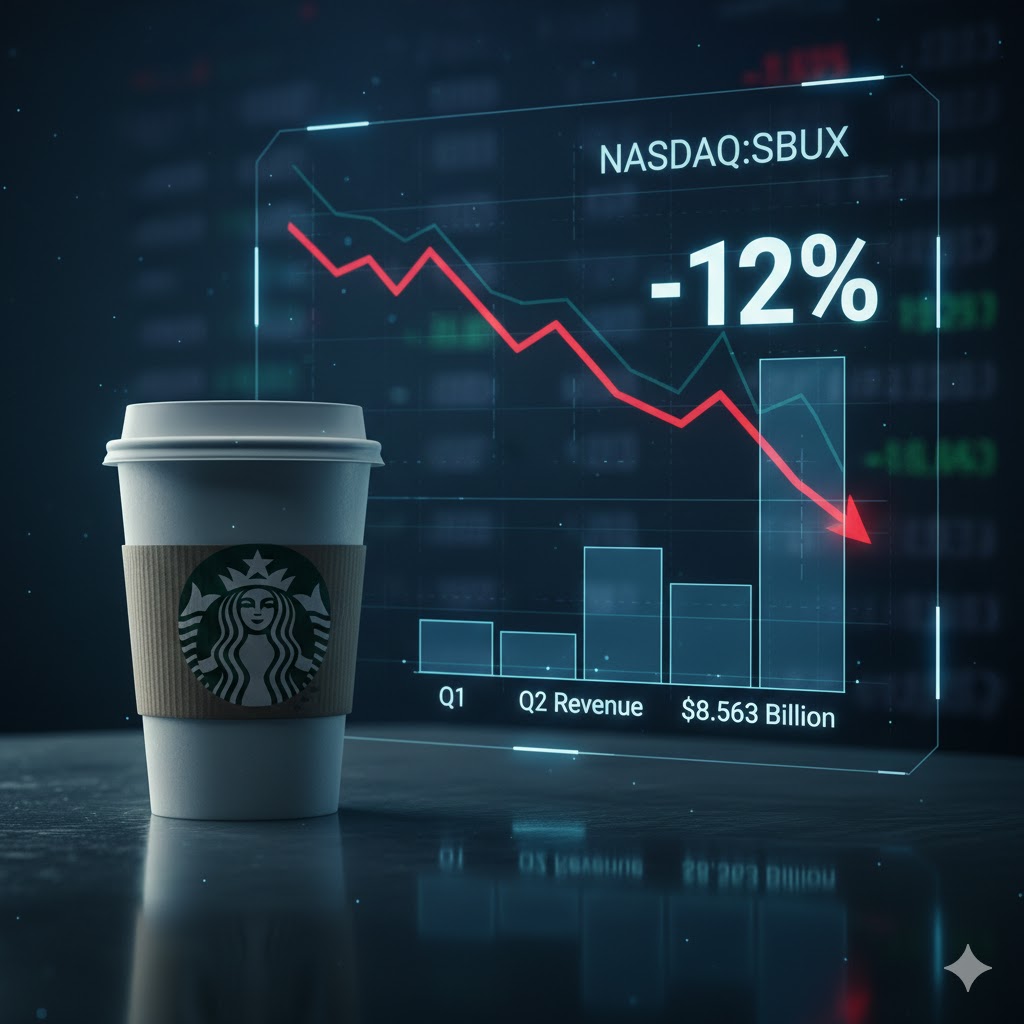

The global consumer discretionary sector faced a significant shock in the early trading hours of this session as Starbucks Corporation (NASDAQ:SBUX) witnessed a dramatic valuation contraction. The Seattle-based coffee giant saw its shares plummet by more than 12% in pre-market activity, a move triggered by the release of its second-quarter fiscal results which failed to meet the lofty expectations of Wall Street analysts and highlighted deepening structural challenges in its primary growth markets. With quarterly revenue coming in at $8.563 billion—a figure that represents a concerning retreat from previous trajectories—the market’s reaction underscores a growing skepticism regarding the brand’s near-term ability to navigate a dual-front crisis consisting of cooling domestic demand and intensifying competition in the Asia-Pacific region.

Financial analysts monitoring the food and beverage industry had projected revenues closer to the $9.1 billion mark, making the $8.563 billion result a staggering miss of nearly $500 million. This underperformance is particularly jarring when viewed through the lens of historical growth patterns, as the company has traditionally leveraged its premium positioning to offset inflationary pressures. However, the Q2 data suggests that the “elasticity of demand” for a $6 latte may have finally reached its breaking point among middle-class consumers. For institutional investors like BlackRock, Inc. (NYSE:BLK) and The Vanguard Group, who hold significant stakes in the company, the primary concern now shifts from mere quarterly earnings to the long-term sustainability of Starbucks’ premium pricing strategy in an increasingly cost-conscious global economy.

The decline in the United States, Starbucks’ largest market, was characterized by a measurable drop in comparable store sales, driven by both lower transaction counts and a plateauing of the average ticket size. Internal reports suggest that the company’s “Rewards” program, while boasting record membership numbers, is struggling to drive frequency among occasional users who are increasingly opting for lower-priced alternatives or home-brewing solutions. The rise of sophisticated home-espresso technology, championed by companies like Breville Group Limited and De’Longhi S.p.A., has created a “stay-at-home” headwind that Starbucks has yet to fully counter. Furthermore, the operational complexities of a diverse menu—ranging from complex seasonal “Refresher” drinks to labor-intensive cold brews—have begun to impact throughput during peak morning hours, leading to customer attrition to more efficient competitors such as Dunkin’ or local independent cafes.

Internationally, the narrative is even more complex, particularly in China, which Starbucks once touted as its secondary engine of growth. The Q2 revenue decline of $8.563 billion was heavily influenced by a sharp contraction in Chinese comparable store sales. In this critical market, Starbucks (NASDAQ:SBUX) is currently locked in a brutal price war with domestic upstarts like Luckin Coffee Inc. (OTC:LKNCY), which has successfully utilized a high-tech, delivery-first model to undercut Starbucks’ “Third Place” philosophy. While Starbucks has attempted to defend its territory by introducing localized products and expanding its own delivery capabilities through partnerships with Meituan (OTC:MPNGY), the data suggests that the Chinese consumer’s preference is shifting toward value-oriented and hyper-convenient offerings. The 12% pre-market plunge is, in many ways, a verdict on the company’s struggle to maintain its status as an aspirational brand in a market where speed and price are increasingly the dominant metrics.

To address these headwinds, Starbucks’ management, led by CEO Laxman Narasimhan, has doubled down on its “Triple Shot Reinvention” strategy. This plan involves accelerating the rollout of the “Siren System,” a suite of new kitchen equipment designed to reduce drink preparation time and alleviate the burden on baristas. However, the capital expenditure required for such a massive hardware overhaul is substantial. In the Q2 report, capital outflows for store improvements and digital integration were cited as a drag on free cash flow, which stood at levels that prompted some analysts to question the security of the current dividend growth rate. While the company maintained its commitment to returning capital to shareholders, the narrowing gap between earnings and payout ratios is a metric that defensive investors are watching with extreme caution.

The broader implications for the retail and hospitality sectors are significant. When a bellwether like Starbucks (NASDAQ:SBUX) reports a revenue miss of this magnitude, it often serves as a “canary in the coal mine” for the wider consumer economy. Peers in the quick-service restaurant (QSR) space, such as McDonald’s Corporation (NYSE:MCD) and Yum! Brands, Inc. (NYSE:YUM), often see their stock prices trade in sympathy with Starbucks during such periods of volatility. If the $8.563 billion revenue figure is indicative of a broader “consumer fatigue,” then the market may be entering a period where volume growth becomes much more difficult to achieve than price-driven growth.

Looking ahead to the remainder of 2026, Starbucks (NASDAQ:SBUX) faces a rigorous path toward recovery. The company’s product development pipeline is currently focused on “functional” beverages—drinks that offer health benefits beyond simple caffeine—intended to capture the Gen Z demographic’s preference for wellness-oriented consumption. Additionally, the company is exploring more aggressive expansion into “drive-thru only” and “pickup only” formats in the U.S. to lower the overhead costs associated with large seating areas that are underutilized in the post-pandemic era. However, the success of these initiatives will depend on the company’s ability to maintain its brand “soul” while operating as a high-speed assembly line.

The pre-market plunge of over 12% also reflects a reset in valuation multiples. For much of the past decade, Starbucks traded at a premium to the broader S&P 500, justified by its consistent mid-to-high single-digit revenue growth and dominant market share. With the Q2 miss, that premium is being aggressively re-evaluated. If the company cannot prove that the $8.563 billion revenue level was a temporary trough rather than a new ceiling, the stock may transition from a “growth” darling to a “value” play, a shift that usually involves a painful period of technical selling as growth-oriented funds exit their positions.

In conclusion, the decline in Starbucks’ revenue and the subsequent market rout represent a critical inflection point for the company. The “coffee-as-an-experience” model is being challenged by “coffee-as-a-commodity” efficiency. To regain its footing, Starbucks (NASDAQ:SBUX) must not only modernize its physical infrastructure but also rediscover its competitive edge in a global market that is no longer content with a one-size-fits-all approach. For investors, the current volatility serves as a reminder that even the most iconic brands are not immune to the shifting sands of consumer behavior and the relentless pressure of localized competition. The road back to $9 billion-plus quarterly revenues will be paved with difficult choices regarding pricing, labor, and international expansion strategy.