As the sun rose on December 30, 2025, the serene boundary between Kentucky and Tennessee became the site of a stark reminder of the inherent risks embedded in the heavy industry of rail transport. A freight train operated by CSX Corporation (NASDAQ: CSX) derailed, sending approximately 30 cars off the tracks. The situation escalated when a car carrying molten sulfur ignited, prompting local authorities to issue an immediate “shelter-in-place” order for nearby residents. While the immediate crisis was managed without reported casualties, the incident serves as a critical focal point for investors and analysts examining the delicate balance between operational expansion and safety protocols in the Class I railroad sector.

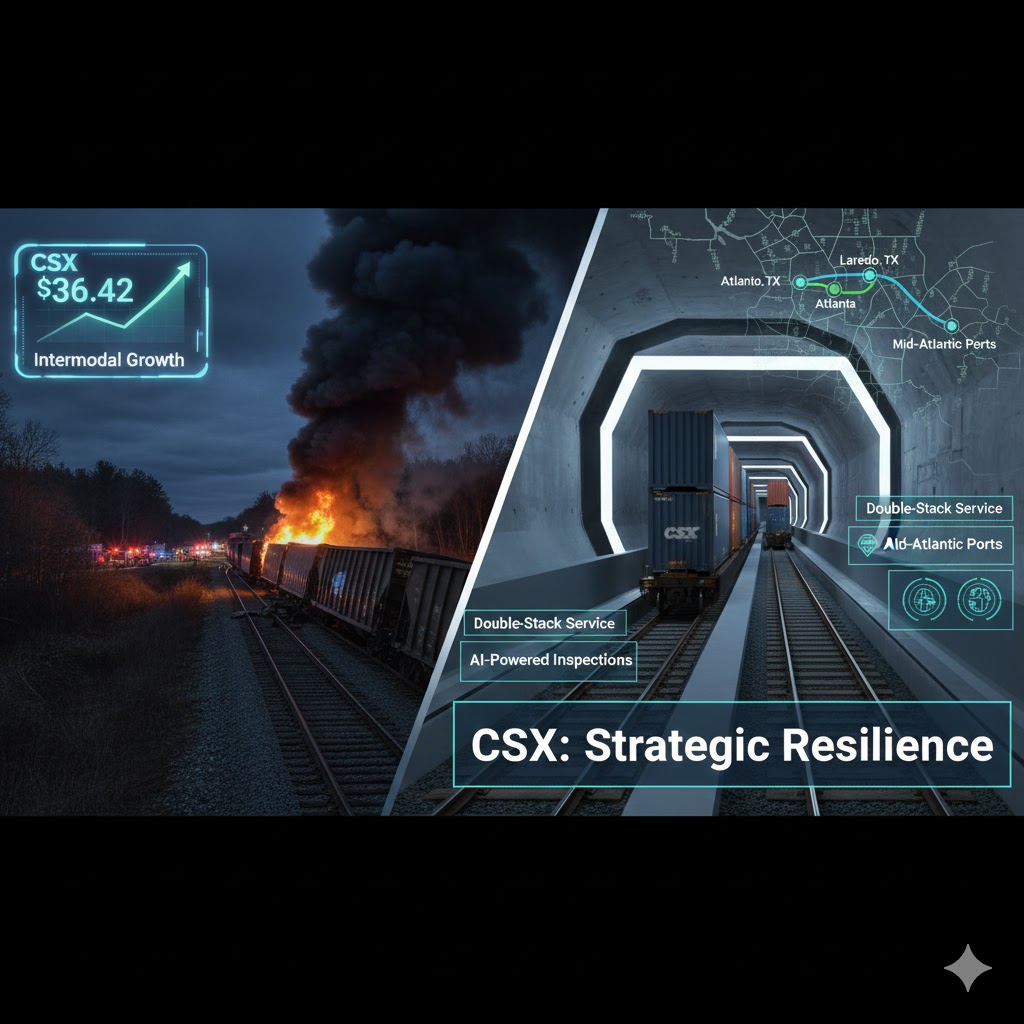

On the final trading day of the year, December 31, 2025, CSX shares are trading at $36.42, reflecting a resilient stance despite the localized disruption. The stock has navigated a complex 2025, reaching a 52-week high of $37.54 earlier in the year. With a market capitalization currently standing at $67.82 billion, CSX remains a titan of the Eastern United States’ logistics infrastructure, operating a network of nearly 20,000 route miles. This report provides a deep-dive analysis into the financial architecture, strategic growth plans, and safety innovations that define CSX as it heads into 2026.

Financial Architecture: Analyzing the Q3 Performance and Year-End Trajectory

CSX’s financial narrative in 2025 has been one of disciplined cost management in the face of fluctuating industrial demand. In its most recent quarterly report (Q3 2025), the company reported an Earnings Per Share (EPS) of $0.44, which outperformed the consensus analyst estimate of $0.42. This “beat” was largely attributed to the “ONE CSX” cultural initiative, which has successfully improved network fluidity and reduced terminal dwell times.

However, revenue for the quarter was reported at $3.59 billion, a marginal 0.9% decrease compared to the same period in 2024. The revenue mix highlights the current shifts in the American economy:

- Merchandise Revenue: Remained the primary pillar, contributing nearly $8.9 billion on an annual basis.

- Intermodal Growth: Stood as a bright spot, with volumes increasing by 4% sequentially, reflecting a successful push to capture freight from the long-haul trucking market.

- Coal Volatility: Export coal prices and volume saw a decline, exerting downward pressure on the top line, which was only partially offset by higher merchandise pricing.

Despite these headwinds, CSX maintains a robust net profit margin of 23.9%. The company’s ability to generate $3.47 billion in annual net income underscores its high operational efficiency. The trailing P/E ratio of 23.68 suggests that investors are willing to pay a premium for the company’s infrastructure moat, especially as earnings are projected to grow by 14.2% in 2026.

Infrastructure Evolution: The Howard Street Tunnel and Beyond

The core of CSX’s business development in 2025 centered on the modernization of legacy infrastructure. A landmark achievement was the completion of the Howard Street Tunnel expansion in Baltimore. This project, which involved lowering the tunnel floor and raising the ceiling, was delivered ahead of schedule in late 2025.

By clearing this 125-year-old bottleneck, CSX is now capable of running double-stack intermodal service along the critical I-95 corridor starting in Q1 2026. This technological and engineering feat is expected to increase business at the Port of Baltimore by approximately 160,000 containers annually, directly competing with East Coast trucking routes. This project is a centerpiece of CSX’s “Market Expansion” strategy, aiming to convert road freight to rail, which is both more cost-effective for shippers and has a lower carbon footprint.

Strategic Alliances: The Mexico-Texas-East Coast Corridor

Looking toward 2026, CSX has positioned itself as a major beneficiary of the “near-shoring” trend in manufacturing. The company has entered a transformational alignment with Canadian Pacific Kansas City (CPKC) to create a new east-west rail corridor. This joint venture involves the acquisition of the Meridian to Myrtlewood rail spur, effectively linking the high-growth manufacturing zones of Mexico with the consumption centers of the U.S. Southeast.

This corridor is designed to unlock new intermodal capacity, allowing goods to flow from Laredo, Texas, through Atlanta and into the mid-Atlantic markets without the need for traditional interchanges. Analysts view 2026 as the “breakthrough year” for this trade route, which aligns with CSX’s goal of diversifying away from its historical reliance on domestic coal and toward high-velocity consumer goods and automotive parts.

Safety Technology: Innovation as a Risk Mitigant

The December 30 derailment highlights the critical importance of CSX’s ongoing investment in safety R&D. The company has been a pioneer in deploying AI-powered inspection portals. These portals utilize high-speed cameras and machine learning algorithms to inspect railcars in real-time as they pass at speeds up to 40 miles per hour. These systems can detect hairline fractures in wheels or loose structural components that the human eye might miss during manual inspections.

Furthermore, CSX has integrated Azure Arc and AI-driven data analytics to optimize track maintenance schedules. By moving from a “reactive” to a “predictive” maintenance model, the company aims to reduce equipment-caused accidents, which have historically accounted for a significant portion of industry-wide derailments. While the cause of the Kentucky-Tennessee border incident is still under federal investigation, CSX’s track-caused accident rate has seen a 56% decline over the last two decades, reflecting the long-term efficacy of these digital advancements.

Conclusion: Navigating the Industrial Crossroads

CSX Corporation enters 2026 at a unique industrial crossroads. On one hand, the company faces the physical and reputational risks inherent in heavy rail operations, as evidenced by the recent sulfur-related derailment. On the other hand, it boasts a modernized infrastructure, a profitable intermodal pivot, and a “fortress” balance sheet with consistent dividend yields (currently 1.43%).

The company’s strategic focus on the I-95 corridor and the cross-border Mexico trade provides a clear roadmap for revenue diversification. While industrial uncertainty persists, CSX’s transition into a “tech-enabled logistics leader” is well underway. For the global markets, CSX represents more than just a railroad; it is a barometer for the health of the American supply chain, balancing nearly 200 years of history with a forward-looking, AI-integrated operational model.

Leave a Reply