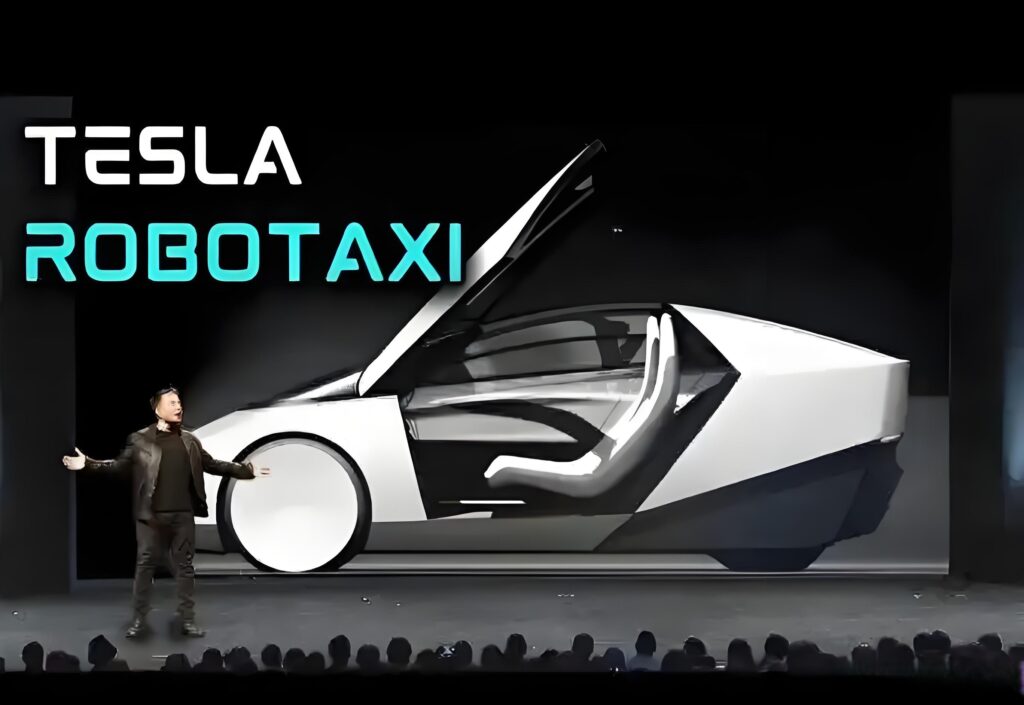

The automotive landscape in early 2026 is defined by a paradox: while global electric vehicle (EV) adoption continues to climb, the pioneers of the industry are facing unprecedented pressure on their legacy business models. Tesla, Inc. (NASDAQ:TSLA), long the bellwether for the sector, has signaled that its future survival and valuation are now inextricably linked to its pivot toward autonomous transport. The company’s “Robotaxi” initiative, centered on the newly christened “Cybercab,” has moved from a speculative engineering goal to a strategic lifeline. As automotive gross margins have stabilized at a lower threshold of 18% to 19% following a multi-year price war, the promise of high-margin, software-driven recurring revenue from a global autonomous network is no longer just an ambition—it is an economic necessity for the Palo Alto giant.

Recent financial disclosures from the fourth quarter of 2025 and preliminary data for January 2026 reveal a company that is aggressively reallocating capital. Tesla reported a record free cash flow of approximately $4 billion in its Q3 2025 results, a war chest that is being funneled directly into “unboxed” manufacturing lines at Gigafactory Texas. This new production philosophy is designed specifically for the Cybercab, a vehicle that omits traditional controls like steering wheels and pedals. By mid-2026, Tesla (NASDAQ:TSLA) aims to begin volume production, with internal targets suggesting an annual capacity of 2 million units once its global factory footprint is fully optimized. This shift represents a transition from a hardware-centric manufacturer to a vertically integrated AI and robotics conglomerate, a move that is being watched closely by institutional giants such as BlackRock, Inc. (NYSE:BLK) and The Vanguard Group.

The Technical Foundation: FSD v13 and the Dojo Edge

The viability of the Robotaxi plan rests entirely on the performance of Tesla’s Full Self-Driving (FSD) software. The rollout of FSD v13 in late 2025 marked a watershed moment for the company. Unlike previous iterations, v13 utilizes an end-to-end neural network that processes vast quantities of real-world video data trained on Tesla’s proprietary Dojo supercomputer. For investors, the critical metric is “miles between critical interventions.” While competitors like Waymo—owned by Alphabet Inc. (NASDAQ:GOOGL)—have maintained a lead in supervised commercial operations in cities like Phoenix and San Francisco, Tesla (NASDAQ:TSLA) is betting on the sheer scale of its “fleet learning” approach. With over 2 billion miles driven on FSD to date, the company possesses an unrivaled dataset for training AI to handle “edge cases”—the rare, unpredictable road events that have traditionally stymied autonomous systems.

Furthermore, the integration of NVIDIA Corporation (NASDAQ:NVDA) H100 and Blackwell-series GPUs into Tesla’s training clusters has reportedly accelerated the iteration cycle of FSD by 10x. This allows the company to deploy software updates that address regional driving nuances, such as the aggressive merges found in Los Angeles or the complex roundabouts common in European markets. For a company like Tesla (NASDAQ:TSLA), which is also developing the Optimus humanoid robot, the synergy between automotive vision and general-purpose robotics creates a “virtuous cycle” of AI development. If the Cybercab can achieve a safety profile that is 5x to 10x better than a human driver, the economic argument for the Robotaxi service becomes irrefutable, potentially lowering the cost of transport to as little as $0.30 to $0.40 per mile.

Navigating the Regulatory and Competitive Labyrinth

The greatest hurdle to Tesla’s autonomous lifeline remains the patchwork of global regulations. In the United States, the National Highway Traffic Safety Administration (NHTSA) has recently updated its guidelines for vehicles without manual controls, a move that directly benefits the Cybercab’s design. However, securing “unsupervised” approval in key states remains a city-by-city battle. Tesla (NASDAQ:TSLA) is currently in active negotiations with transport authorities in Texas and Florida, aiming for the first fully autonomous commercial pilots by the third quarter of 2026. This regulatory friction is where Tesla faces its most significant “time-to-market” risk. While Waymo has already logged millions of driverless miles, it relies on expensive LiDAR sensors, whereas Tesla (NASDAQ:TSLA) remains committed to a “vision-only” approach, arguing that it is the only way to achieve the sub-$30,000 vehicle cost required for global scale.

The competitive landscape is also diversifying. In China, local champions such as BYD Co. Ltd. (OTC:BYDDF) and Xiaomi Corporation (OTC:XIACY) are aggressively testing their own autonomous suites. Baidu, Inc. (NASDAQ:BIDU), through its Apollo Go service, has already surpassed 7 million cumulative rides in China, providing a formidable benchmark for Tesla’s expansion in the region. To compete, Tesla (NASDAQ:TSLA) has recently forged a strategic partnership with local mapping and data providers in China to ensure compliance with strict data sovereignty laws. This “localized” strategy is essential if Tesla hopes to launch its Robotaxi network in Tier-1 cities like Shanghai and Beijing, where the demand for affordable, high-tech ride-hailing is insatiable.

Financial Engineering and the “Network Effect”

From a business development perspective, the Robotaxi service is designed to transform the Tesla (NASDAQ:TSLA) balance sheet. Currently, the company relies on one-time hardware sales, which are subject to cyclical consumer demand and interest rate fluctuations. The Robotaxi network, however, operates on a “take rate” model. Tesla (NASDAQ:TSLA) plans to allow existing owners of FSD-equipped vehicles to add their cars to the fleet when not in use, with the company taking a percentage of each fare. This creates a “network effect”: as more vehicles join, the service becomes more reliable, attracting more users and generating more training data, which in turn improves the safety and efficiency of the system.

Analyst projections for 2026 suggest that if Tesla (NASDAQ:TSLA) can capture even 5% of the global ride-hailing market—currently dominated by Uber Technologies, Inc. (NYSE:UBER) and Lyft, Inc. (NASDAQ:LYFT)—it could add $50 billion to $70 billion to its annual revenue at software-like margins. This potential for “asymmetric growth” is why the stock continues to trade at a significant premium compared to traditional OEMs like Ford Motor Company (NYSE:F) or General Motors Company (NYSE:NYSE:GM). However, the execution risk is high. Any high-profile safety incident involving an unsupervised Tesla (NASDAQ:TSLA) could trigger a regulatory “freeze” that would set the program back by years, making the current period one of the most volatile in the company’s history.

In conclusion, the Robotaxi plan is the ultimate high-stakes bet for Tesla, Inc. (NASDAQ:TSLA). It is a strategy born of both necessity and vision—a lifeline intended to pull the company out of the “commodity trap” of the broader EV market and into the stratosphere of AI services. By leveraging its lead in silicon training, fleet data, and manufacturing innovation, Tesla (NASDAQ:TSLA) is attempting to build the world’s first scalable, autonomous transportation utility. For the global economy of 2026, the success or failure of this plan will serve as the definitive case study on the commercialization of artificial intelligence. As the first production Cybercabs begin to roll off the lines in Austin, the market’s eyes will be fixed not on the number of cars delivered, but on the number of miles driven without a human hand on the wheel.

Leave a Reply