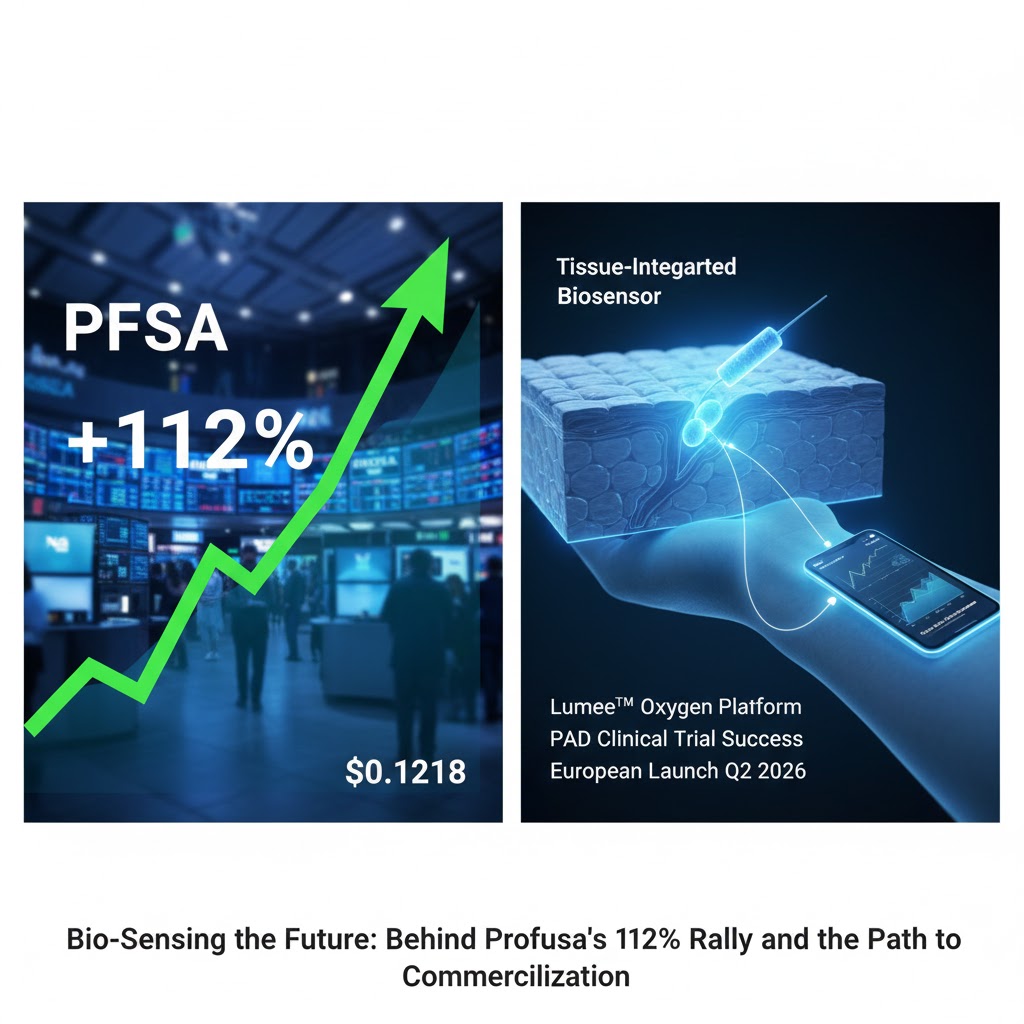

On December 30, 2025, while many in the financial world were winding down for the year-end, the Nasdaq Global Market witnessed a dramatic surge from an unlikely contender. Profusa, Inc. (NASDAQ: PFSA), a Berkeley-based pioneer in tissue-integrated biosensors, saw its shares skyrocket by over 112%, reaching an intraday high of $0.1695 before settling at $0.1218 by the close. This surge, backed by a staggering volume of over 833 million shares, represents more than a mere speculative spike; it is a market reaction to a comprehensive balance sheet overhaul and a clarified roadmap toward 2026 revenue generation.

As of December 31, 2025, Profusa holds a market capitalization of approximately $7.8 million. While the stock has faced significant downward pressure throughout the year—previously hitting a 52-week low of $0.065—the recent price action suggests a fundamental shift in investor sentiment regarding the company’s survival and its ability to commercialize its flagship Lumee™ Oxygen Platform. This report explores the financial restructuring that ignited this rally, the technical progress of its bio-sensing technology, and the company’s aggressive market expansion plans.

The Capital Catalyst: Restructuring for Flexibility

The primary driver of the December 30 rally was a transformative restructuring of Profusa’s Senior Secured Convertible Note. Historically, the company has been hindered by restrictive debt terms and the constant threat of share dilution. The newly announced amendments, however, fundamentally alter the company’s financial architecture:

- Elevated Conversion Floor: The conversion floor price for the notes was increased from $0.10 to $0.35. This is a critical psychological and technical threshold, as it protects current shareholders from excessive dilution at depressed price levels.

- Elimination of Amortization Pressures: The company successfully removed mandatory cash and equity amortization payments that were originally scheduled to commence in Q1 2026. This move preserves vital cash reserves for operational scaling and inventory build-up.

- Enhanced Equity Line of Credit (ELOC): Profusa increased mandatory payments related to its ELOC from 17.5% to as high as 50% for future registrations. This provides a more efficient mechanism for capital injection as the company nears its commercial launch.

CFO Fred Knechtel noted that these steps are part of a broader “de-risking” strategy. By reducing net debt from $48 million in mid-2024 to approximately $14 million as of October 31, 2025, Profusa has significantly cleared its path to enterprise value growth.

Technical Milestones: The Science of Lumee™

At the heart of Profusa’s business is its unique approach to continuous biochemical monitoring. Unlike traditional wearables that sit on top of the skin, Profusa’s biosensors are tissue-integrated. These tiny, “smart” hydrogels are injected under the skin, where they integrate with the surrounding tissue to provide clinical-grade data without the “foreign body response” (inflammation or scarring) that typically plagues implantable devices.

In December 2025, the company presented late-breaking clinical data from its U.S. study at Paris Vascular Insights. The study met its primary endpoints, demonstrating the effectiveness of the Lumee™ Oxygen Platform in monitoring tissue oxygenation in patients with Peripheral Artery Disease (PAD). This validation is a prerequisite for the company’s anticipated 2026 revenue targets.

Market Expansion and 2026 Revenue Roadmap

Profusa has outlined a detailed “Pillar” strategy to transition from a clinical-stage entity to a commercial powerhouse:

- European Launch (Q2 2026): The company has already signed a letter of intent with Angiopro GmbH to establish the logistics and commercialization infrastructure across key European markets. Current distribution partnerships already cover roughly 35% of the European population.

- U.S. Market Entry (2027): Following the successful U.S. clinical trials, Profusa plans a mid-2026 FDA submission, targeting a commercial launch in the United States by mid-2027.

- Revenue Scaling: Management has set conservative targets for the near term, projecting $0.5 million to $2 million in 2026 revenue, scaling to $9 million to $13 million in 2027. However, the long-term goal is far more ambitious: a target of $200 million to $250 million in annual revenue by 2030.

To support these targets, Profusa has already completed key manufacturing milestones. Current production capacity is reportedly twice what is needed for the initial 2026 sensor demand, ensuring that the company can scale rapidly without the typical supply-chain bottlenecks seen in med-tech startups.

Conclusion: A High-Beta Bet on Bio-Intelligence

Profusa’s 112% surge on December 30 acts as a barometer for the market’s appetite for restructured med-tech firms. While the company still operates with a significant net loss and a small employee base, the “re-capitalization” event has effectively reset the clock. By pushing back debt obligations and raising the conversion floor, Profusa has bought itself the time necessary to prove the commercial viability of its Lumee™ platform.

As 2026 approaches, the market will transition from watching balance sheets to watching sales figures. The success of the Angiopro partnership in Europe will be the definitive test of whether Profusa can transform its bio-sensing breakthroughs into a sustainable, high-growth business.

Leave a Reply