n December 18, Bridgeline Digital, Inc. released its most recent earnings results, drawing renewed attention to a micro-cap software company that has struggled to gain sustained momentum in public markets. Bridgeline Digital operates in the competitive digital experience and enterprise search software space, where artificial intelligence, personalization, and data-driven commerce increasingly define success.

At first glance, the headline figures from the latest earnings announcement appear unremarkable: revenue growth remains muted, profitability is still elusive, and the BLIN stock price continues to trade at depressed levels. Yet beneath these surface-level metrics lies a more complex narrative. The most recent BLIN Financial Report highlights a company that is deliberately reshaping its revenue mix, investing heavily in AI-driven products, and attempting to position itself for longer-term operating leverage rather than short-term optical growth.

This report provides a deep, data-driven analysis of Bridgeline Digital stock, focusing on the underlying drivers of financial performance, the strategic rationale behind management’s decisions, and the potential implications for future revenue, profitability, and valuation. By examining the company’s latest earnings in detail, investors can better assess whether BLIN stock represents a value trap—or an underappreciated strategic option in an evolving software market.

Company Overview and Business Model Evolution

Bridgeline Digital is a U.S.-based software company specializing in digital experience platforms, enterprise search, and AI-powered commerce solutions. Historically, the company generated a significant portion of its revenue from professional services and custom digital implementations. While this model provided steady cash flow, it limited scalability and suppressed margins.

Over the past several years, management has pursued a strategic pivot toward a subscription-centric software-as-a-service model. Central to this transition is HawkSearch, Bridgeline Digital’s AI-driven search and recommendation platform designed primarily for B2B and e-commerce customers. HawkSearch enables businesses to improve product discovery, personalize user experiences, and increase conversion rates through machine learning and automated relevance tuning.

This shift in business model is critical to understanding the long-term thesis for Bridgeline Digital stock. Subscription-based software revenue typically commands higher valuation multiples, offers greater predictability, and supports stronger operating leverage than services-heavy models. The latest earnings release suggests that this transition is well underway, even if its financial benefits are not yet fully reflected in reported results.

Overview of the Latest Financial Results

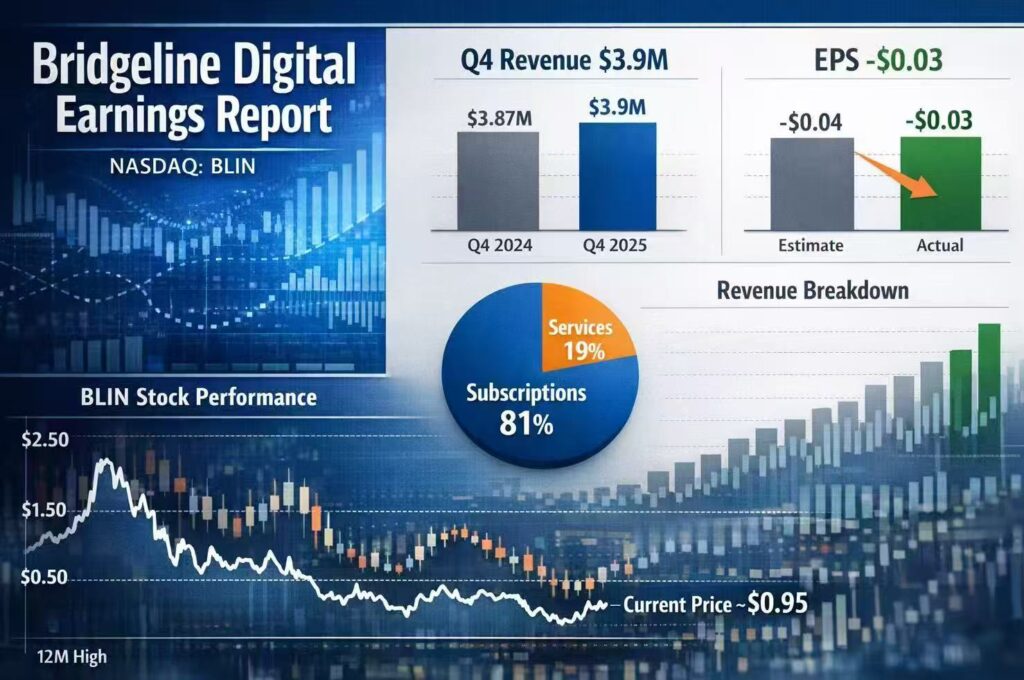

According to the December 18 earnings release, Bridgeline Digital reported quarterly revenue of approximately $3.9 million, representing essentially flat performance compared with the same period in the prior year. While the lack of top-line growth may initially disappoint investors, the composition of that revenue tells a more nuanced story.

Subscription revenue continued to increase as a percentage of total sales, now accounting for more than 80% of overall revenue. Gross margins remained solid, reflecting the inherently attractive economics of the company’s software offerings. At the same time, operating losses persisted, as increased investment in product development and go-to-market initiatives offset margin gains.

From a purely numerical standpoint, the latest Bridgeline Digital Earnings report neither signals a dramatic turnaround nor a significant deterioration. Instead, it reflects a company in the midst of a structural transition—one that prioritizes long-term value creation over near-term earnings optics.

Revenue Analysis: Flat Growth, Improving Quality

The most frequently cited concern surrounding BLIN stock is the company’s inability to generate sustained revenue growth. A closer examination of the revenue breakdown, however, reveals that stagnation at the headline level masks meaningful internal changes.

Subscription Versus Services Revenue

Subscription revenue continues to grow modestly, driven primarily by HawkSearch renewals, expansions, and feature upgrades. Existing customers are increasing their spend over time, suggesting that the product delivers tangible value. This is supported by net revenue retention rates above 110%, indicating that expansion revenue more than offsets churn.

In contrast, professional services revenue declined during the period. This decline is not accidental; it reflects management’s strategic decision to deprioritize lower-margin, labor-intensive services work. While this choice reduces reported revenue in the short term, it improves long-term scalability and margin potential.

For investors evaluating BLIN stock, this distinction is critical. Revenue quality matters as much as revenue quantity, particularly for a software company seeking to reposition itself as a scalable SaaS provider.

Sales Cycles and Pipeline Dynamics

Another factor contributing to flat revenue is elongated enterprise sales cycles. Management has indicated that while the sales pipeline has expanded, customer decision-making has slowed due to cautious IT spending and budget scrutiny. Importantly, delayed deal closures do not necessarily imply reduced demand; they often reflect timing issues that can reverse as macro conditions stabilize.

If sales cycle improvements translate into higher conversion rates, revenue growth could accelerate without a proportional increase in operating expenses—a dynamic that would materially improve the outlook for Bridgeline Digital stock.

Profitability, Margins, and Cost Structure

Despite continued net losses, Bridgeline Digital’s gross margins remain healthy, underscoring the inherent attractiveness of its software offerings. Gross margins in the mid-60% range compare favorably with many small-cap software peers and suggest that the core product economics are sound.

Operating expenses increased moderately during the period, driven primarily by:

- Investment in AI and product development

- Sales and marketing initiatives to support HawkSearch adoption

- Ongoing cloud infrastructure and compliance costs

While these investments weigh on near-term profitability, they are strategically aligned with the company’s long-term objectives. Management has demonstrated relative discipline in cost control, preventing losses from expanding disproportionately to revenue.

From a forward-looking perspective, the key question for BLIN stock investors is whether revenue growth will eventually outpace expense growth. If it does, the operating leverage inherent in the model could lead to rapid margin expansion.

Cash Position and Balance Sheet Considerations

Bridgeline Digital maintains a relatively clean balance sheet with manageable debt levels. Cash reserves are sufficient to support near-term operations, though not excessive. This places added importance on disciplined capital allocation and gradual progress toward breakeven cash flow.

For a micro-cap stock like BLIN, balance sheet risk is a critical consideration. While the company may eventually require additional capital to accelerate growth, the absence of heavy leverage reduces financial risk and preserves strategic flexibility.

Product Strategy: AI as a Differentiator

The most compelling element of the BLIN Financial Report lies in the company’s product roadmap and AI strategy. HawkSearch has evolved beyond basic site search into a more comprehensive AI-driven discovery platform. Recent enhancements include generative AI capabilities, improved relevance algorithms, and deeper analytics.

These features serve multiple strategic purposes. They increase product differentiation in a crowded market, support premium pricing, and create opportunities for upselling existing customers. Over time, such enhancements can materially increase average revenue per user and customer lifetime value.

If successful, this product-led growth strategy could transform Bridgeline Digital from a low-growth niche player into a more scalable AI-enabled software company. This possibility represents the core upside thesis for Bridgeline Digital stock.

Market Opportunity and Competitive Landscape

Bridgeline Digital operates in a highly competitive environment that includes both large enterprise software vendors and specialized AI startups. While the company lacks the scale of industry giants, it competes by focusing on specific use cases—particularly B2B commerce and enterprise search—where generic solutions often fall short.

The broader market opportunity is supported by several secular trends, including the growing importance of personalization, the rise of AI-driven customer experiences, and the continued expansion of digital commerce. However, competitive pressure remains intense, and sustained innovation will be necessary to maintain relevance.

Valuation Perspective and BLIN Stock Price Outlook

At current levels, the BLIN stock price reflects significant skepticism about the company’s growth prospects. Valuation metrics such as price-to-sales remain well below those of higher-growth SaaS peers. While this discount is partially justified by slow growth and ongoing losses, it also embeds a pessimistic view of the company’s strategic pivot.

A scenario-based valuation framework is more appropriate for assessing BLIN stock. In a downside scenario where revenue remains stagnant and losses persist, the stock may continue to trade at depressed levels. In a base-case scenario where subscription growth accelerates modestly and losses narrow, even a partial multiple re-rating could generate meaningful upside. In a bullish scenario where AI-driven offerings gain traction and profitability emerges, the current valuation would appear deeply undervalued in hindsight.

Investment Risks

Despite its potential, Bridgeline Digital faces several material risks. These include execution risk related to product development and sales, competitive pressure from larger players, and the inherent volatility of micro-cap stocks. Liquidity constraints can amplify price movements, making BLIN stock unsuitable for risk-averse investors.

Investment Recommendation: Buy, Hold, or Sell?

Based on the detailed analysis of the latest Bridgeline Digital Earnings, the company appears to be in a transitional phase rather than a terminal decline. For investors with a high tolerance for risk and a long-term horizon, BLIN stock may represent a speculative Buy, offering exposure to a niche AI-driven software platform with improving revenue quality.

More conservative investors may prefer a Hold stance until clearer evidence of sustained revenue growth emerges. A Sell recommendation would be more appropriate only if execution falters or the company fails to translate its strategic investments into measurable financial progress.

Conclusion: A Strategic Option Embedded in a Small-Cap Stock

The December 18 earnings release underscores that Bridgeline Digital is neither a straightforward turnaround nor a structurally broken business. Instead, it represents a company attempting to reposition itself for relevance in an AI-driven software landscape. The latest BLIN Financial Report highlights improving revenue quality, solid margins, and a product strategy aligned with long-term market trends.

Whether Bridgeline Digital stock ultimately rewards investors will depend on management’s ability to execute over the next several quarters. For now, BLIN stock remains a high-risk, high-optionality investment—one where patience and disciplined analysis are essential.

Leave a Reply