RYAAY Stock Not Found

The symbol you searched for does not exist in our database.

Recommendation: We have selected CSX for you instead.

CSX Corporation (CSX)

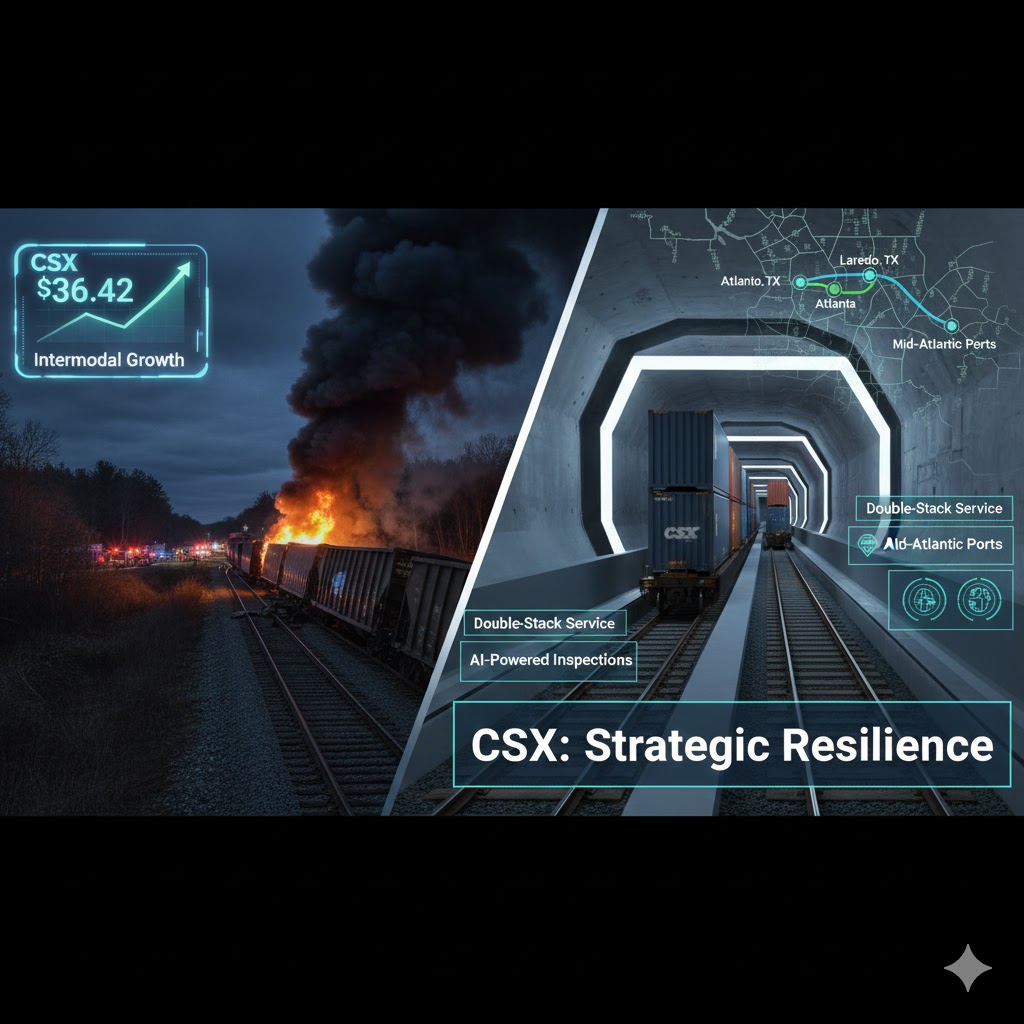

CSX Corporation (Nasdaq: CSX) is a leading supplier of rail-based freight transportation services and a backbone of the U.S. supply chain, connecting major metropolitan areas across the Eastern United States. With a mission to be the safest and most efficient railroad in North America, the company operates an extensive network of over 20,000 miles of track. In the logistics landscape of late 2025, CSX Corporation stock is viewed as a critical "Industrial Bellwether," benefiting from the ongoing revitalization of domestic manufacturing and the shift toward more fuel-efficient intermodal transport. The company’s strategic focus on "Scheduled Railroading" has significantly improved service reliability, allowing it to capture market share from long-haul trucking.

Operational highlights in late 2025 include the successful rollout of autonomous inspection technology and the expansion of its "Hydrogen-Powered Locomotive" pilot program. Investors tracking CSX stock have cheered the company’s ability to maintain a sub-60% operating ratio despite rising labor costs and fluctuating fuel prices. The company’s core products include the transport of coal, agricultural goods, automotive parts, and consumer merchandise via its intermodal containers. The future business strategy involves the development of "Integrated Logistics Hubs" that combine rail, trucking, and warehousing services to provide a seamless end-to-end solution for global shippers. Throughout 2025, CSX has demonstrated exceptional capital discipline, returning billions to shareholders through share repurchases and consistent dividend increases.

The CSX stock price is currently trading near $38, reflecting the market’s optimism regarding a rebound in industrial production and the company’s peer-leading margins. Analysts monitoring the stock price emphasize the company’s massive barriers to entry and its role as a primary beneficiary of the "Near-Shoring" trend in North America. For those tracking the market today, the key catalysts include the volume growth in the merchandise segment and the continued efficiency gains from its digital dispatch systems. As a titan of the transportation world, the company remains a top selection for long-term growth and income investors. The steady climb of the stock price reflects its role as a vital engine of global commerce.