Investors are increasingly realizing that the artificial intelligence (AI) sector not only holds investment opportunities but also contains significant risks.

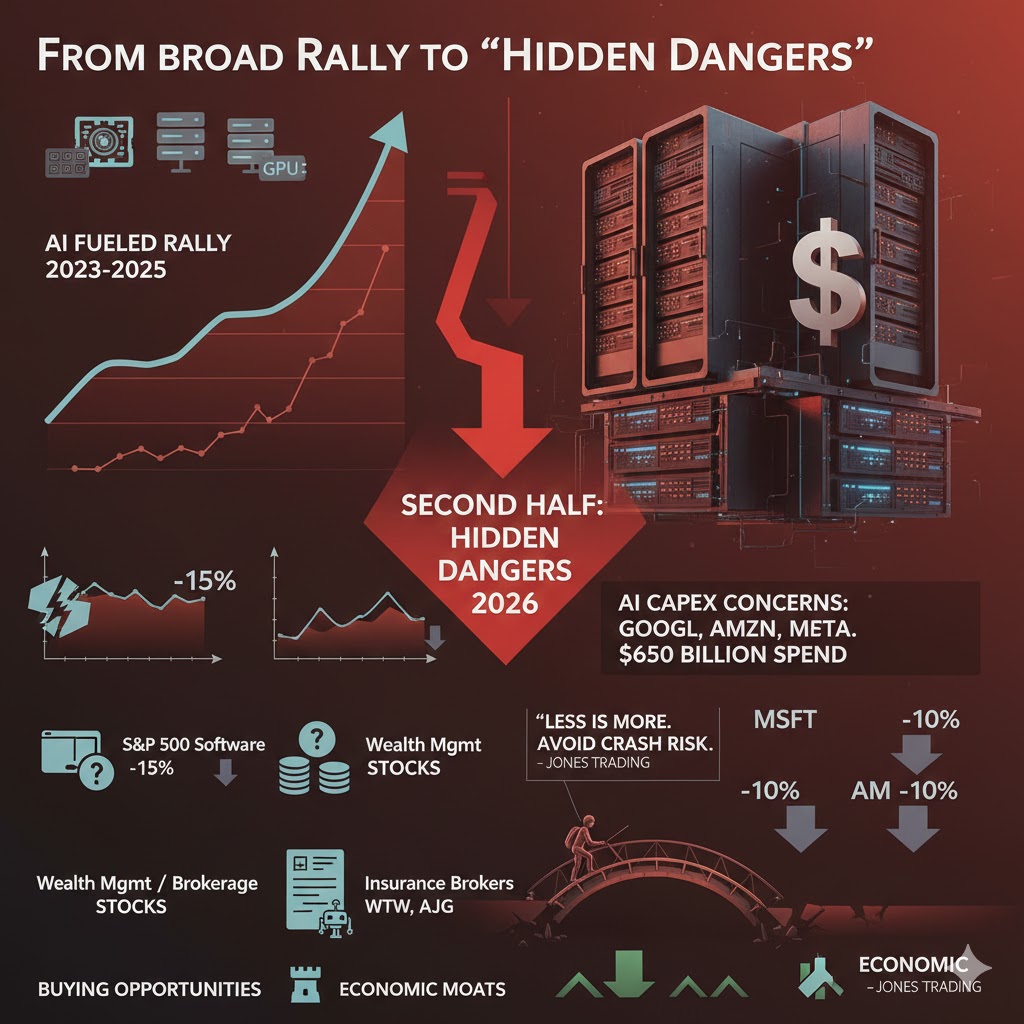

The optimism surrounding AI has fueled the bull market in the U.S. stock market over the past three years, with tech companies and those involved in data center construction and related infrastructure seeing their stock prices soar.

Despite the U.S. stock market’s continuous growth over the past three years, many investors were still optimistic about the outlook for 2026. They believed that AI would start to broadly boost corporate profits from this year onward.

However, recent shifts in market sentiment have raised concerns about AI’s disruptive potential. Industries such as software, legal services, and wealth management have been impacted, and investors are rethinking how to assess the value of these companies.

In January of this year, AI star company Anthropic launched its AI collaboration tool, Claude Cowork, which triggered a sell-off in software stocks. As of Wednesday, the S&P 500 Software and Services Index has dropped by 15% since the end of January.

This week, market concerns about AI’s disruptive potential have spread to other sectors. Wealth management startup Altruist launched an AI-powered tax planning feature, causing a sharp decline in brokerage stocks; and online insurance platform Insurify launched an AI comparison tool based on ChatGPT, leading to a decline in stocks of insurance brokers such as Willis Towers Watson (NASDAQ:WTW) and Arthur J. Gallagher (NYSE:AJG).

At the same time, doubts surrounding the massive capital expenditures for AI are weighing down the stock prices of some of the world’s largest companies, including Google (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and Microsoft (NASDAQ:MSFT).

Google, Meta Platforms (NASDAQ:META), Microsoft, and Amazon have all announced large capital expenditure plans, with these four tech giants set to spend a total of $650 billion this year, primarily on expanding AI infrastructure.

Concerns that the tech giants may not be able to generate sufficient returns from these high capital expenditures have led to double-digit declines in the stock prices of both Microsoft and Amazon after they announced their earnings.

Yung-Yu Ma, Chief Investment Strategist at PNC Financial Services Group (NYSE:PNC), stated: “The market is concerned that they have spent too much money… I think this is still an open question.”

He added that “the negative sentiment around these expenditures will likely ease over time.”

Keith Lerner, Chief Investment Officer at Truist Advisory Services, said: “The challenge right now is that AI is advancing too quickly. Corporate earnings are still strong, but companies find it hard to counter the negative narrative in the market.”

However, some investors believe that, as valuations become more attractive, buying opportunities are emerging.

When assessing the impact of AI development, Sean Dunlop, Director of Equity Research at Morningstar, stated that economic “moats” can help investors “discriminate to some extent between high-quality and low-quality companies, and the current sell-off is somewhat blind, which creates investment opportunities.”

Michael O’Rourke, Chief Market Strategist at JonesTrading, remarked in a report: “In 2026, less is more, and the key to stock picking will be avoiding the risk of a crash.”