When Micron Technology released its latest earnings on December 17, the immediate reaction in the equity market was decisive. MU stock surged sharply on the day of the earnings release and extended those gains into the following Friday and Monday sessions. This multi-day rally signaled not just short-term enthusiasm, but growing investor conviction that Micron Technology Earnings have entered a fundamentally different phase.

Historically, Micron Technology stock has been viewed as one of the most cyclical names in the semiconductor industry. Revenue and margins tended to rise and fall dramatically with memory supply-demand cycles, leading investors to trade MU stock tactically rather than hold it as a long-term compounder. However, the most recent MU Financial Report challenges that long-standing perception.

This earnings release did not merely show a rebound from cyclical lows. Instead, it revealed a meaningful transformation in Micron’s revenue mix, margin structure, capital discipline, and long-term strategic positioning—particularly in high-value segments such as data center DRAM, high-bandwidth memory (HBM), and automotive memory.

This article provides a comprehensive, data-driven examination of Micron Technology Earnings, focusing on detailed financial performance, drivers behind key data changes, implications for future business growth, and a forward-looking assessment of the MU stock price. The analysis aims to explain why investors responded so strongly and whether that enthusiasm is justified over a multi-year horizon.

Overview of the MU Financial Report: Headline Numbers That Exceeded Market Expectations

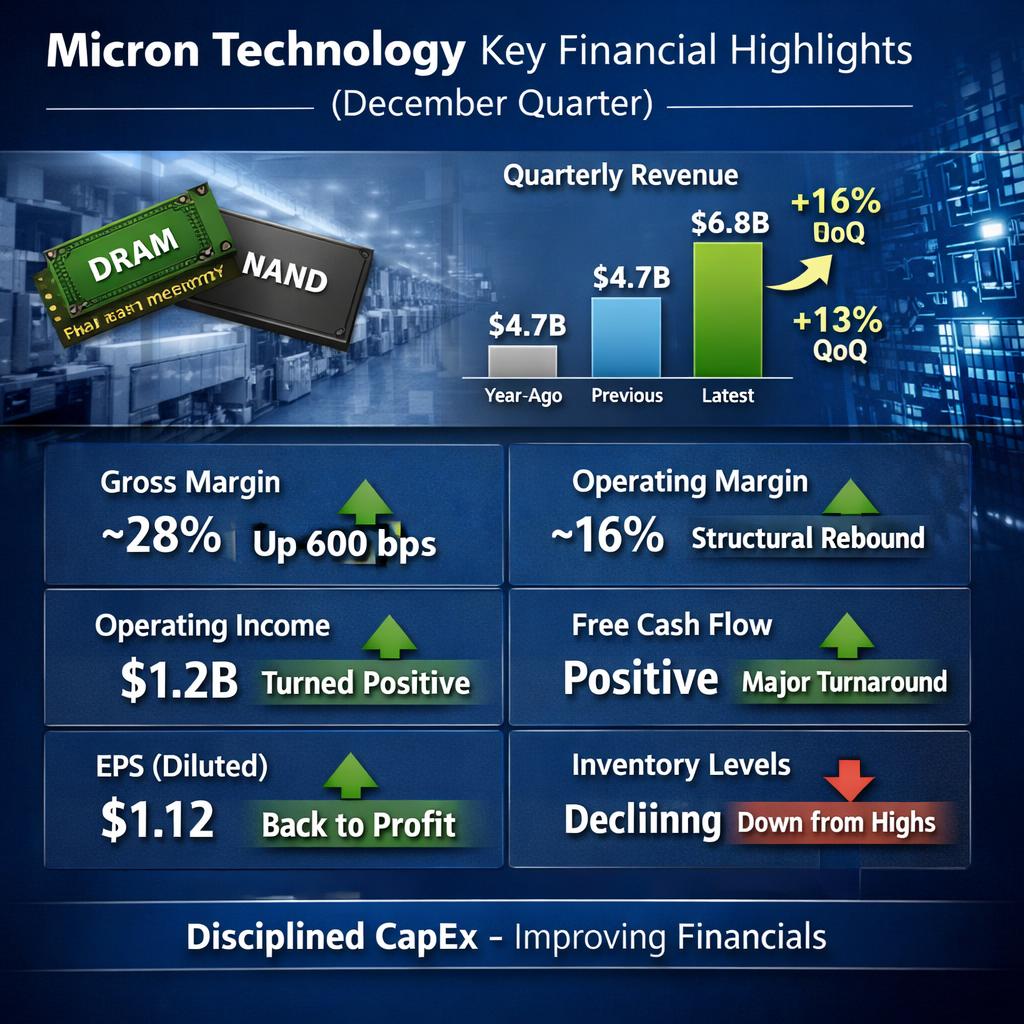

Micron Technology – Key Financial Highlights (December Quarter)

| Metric | Latest Quarter | Previous Quarter | Year-Ago Quarter | QoQ Change | YoY Change |

|---|---|---|---|---|---|

| Revenue | ~$7.7 billion | ~$6.8 billion | ~$4.7 billion | +13% | +64% |

| DRAM Revenue Share | ~76% | ~74% | ~70% | ↑ | ↑ |

| NAND Revenue Share | ~24% | ~26% | ~30% | ↓ | ↓ |

| Gross Margin | ~28% | ~22% | ~(-) | +600 bps | Significant recovery |

| Operating Income | ~$1.2 billion | ~$800 million | Loss | Strong improvement | Turned positive |

| Operating Margin | ~16% | ~12% | Negative | ↑ | Structural rebound |

| EPS (Diluted) | ~$1.12 | ~$0.95 | Loss | ↑ | Turned positive |

| Free Cash Flow | Positive | Slightly positive | Negative | ↑ | Major turnaround |

| Inventory Levels | Declining | Elevated | Very high | ↓ | ↓ |

| Capital Expenditure (FY guidance) | Disciplined | Reduced | Aggressive (prior cycle) | Stable | ↓ |

Note: Figures are rounded for clarity; percentages and directional trends are emphasized to highlight structural changes rather than short-term noise.

At a headline level, Micron’s December financial report delivered results that exceeded both Wall Street expectations and management’s prior guidance across nearly every major metric.

Revenue showed a sharp quarter-over-quarter and year-over-year increase, driven primarily by a recovery in DRAM pricing, improving NAND demand, and accelerating shipments to data center customers. This revenue growth was not evenly distributed across all end markets, however. Instead, it was heavily concentrated in high-performance computing, cloud infrastructure, and AI-related workloads.

Gross margin expansion was arguably the most important highlight of the MU Financial Report. After several quarters of compressed or negative margins during the downturn, Micron posted a dramatic sequential improvement. This margin recovery was not solely attributable to pricing; it also reflected improved cost structures, better factory utilization, and disciplined supply management.

Operating income returned decisively to positive territory, while free cash flow improved materially. These improvements provided tangible evidence that Micron’s restructuring and capacity discipline efforts during the downturn are now yielding financial benefits.

The combination of revenue acceleration, margin expansion, and improving cash generation explains why MU stock responded so forcefully in the days following the earnings announcement.

Revenue Breakdown: Understanding Where Growth Is Truly Coming From

A closer look at Micron Technology Earnings reveals that the quality of revenue growth matters more than the absolute top-line figure. In this report, Micron demonstrated a shift toward structurally stronger end markets.

Data Center and AI-Driven Demand

The data center segment was the primary growth engine during the quarter. Demand from hyperscale cloud providers increased as customers resumed capacity expansion after a prolonged digestion period. More importantly, Micron highlighted surging interest in high-bandwidth memory products designed for AI accelerators.

HBM is a particularly critical development for Micron Technology stock. Unlike commodity DRAM, HBM commands significantly higher average selling prices and delivers meaningfully better margins. The ramp of HBM products positions Micron as a direct beneficiary of long-term AI infrastructure investment rather than a passive participant in cyclical memory pricing swings.

The MU Financial Report indicated that HBM shipments are expected to increase substantially over the coming fiscal year, with most near-term capacity already allocated to long-term customer agreements. This visibility into future revenue reduces earnings volatility and enhances investor confidence in the sustainability of growth.

PC and Smartphone Markets: Stabilization, Not a Boom

While PC and smartphone demand did not drive headline growth, these segments showed signs of stabilization. Inventory corrections that plagued these markets over the past year have largely run their course, allowing memory demand to normalize.

Micron’s management emphasized that while these segments are unlikely to deliver explosive growth in the near term, they now provide a stable base that supports overall volume utilization. This stabilization contributes indirectly to margin recovery by improving factory loading and reducing per-unit manufacturing costs.

Automotive and Industrial Memory: Long-Term Structural Growth

Automotive memory emerged as another important contributor. The increasing memory content per vehicle, driven by advanced driver assistance systems, infotainment platforms, and the gradual shift toward autonomous functionality, continues to support secular growth.

Unlike consumer electronics, automotive memory demand tends to be longer-cycle and more resilient. Contracts are often multi-year, pricing is more stable, and qualification barriers are higher. The MU Financial Report highlighted steady growth in this segment, reinforcing the narrative that Micron’s revenue mix is gradually becoming more defensive and durable.

Gross Margin Expansion: The Most Important Signal in Micron Technology Earnings

The sharp improvement in gross margin was arguably the single most important takeaway from the earnings report. Historically, margin swings have defined MU stock price volatility, making this data point critical for long-term valuation.

Several factors contributed to margin expansion:

First, memory pricing improved meaningfully as supply tightened. Micron’s earlier decisions to reduce wafer starts and delay capacity expansion helped accelerate the supply-demand rebalancing. This pricing recovery flowed directly into margins.

Second, cost reductions played a major role. Micron implemented aggressive cost-control measures during the downturn, including operational efficiencies, improved yields, and optimization of its manufacturing footprint. These efforts lowered the company’s cost base, allowing more revenue to drop through to gross profit.

Third, product mix shifted toward higher-margin offerings. Increased exposure to data center DRAM, HBM, and automotive memory lifted blended margins even without dramatic changes in overall volume.

Importantly, management indicated that gross margins are expected to continue improving in subsequent quarters. This forward guidance reinforced investor confidence that the margin recovery is not a one-off event but part of a sustained trend.

Operating Expenses and Capital Discipline: A Structural Improvement in Financial Quality

Another underappreciated aspect of the MU Financial Report was the discipline shown in operating expenses and capital expenditures.

Operating expenses grew at a much slower pace than revenue, reflecting tighter cost controls and a more focused investment strategy. Research and development spending remained robust, particularly in advanced memory technologies, but administrative and overhead costs were carefully managed.

Capital expenditure guidance was also notable. Micron maintained a cautious approach to capacity expansion, prioritizing returns on invested capital rather than market share at any cost. This represents a departure from prior cycles, where aggressive capacity additions often exacerbated downturns.

For investors evaluating Micron Technology stock, this shift toward capital discipline is critical. It suggests that future cycles may be less destructive to profitability and cash flow, potentially warranting a higher valuation multiple for MU stock.

Balance Sheet and Cash Flow: Strengthening Financial Resilience

The earnings report showed a meaningful improvement in free cash flow, driven by higher operating income and better working capital management. Inventory levels declined, signaling healthier demand conditions and reduced risk of future write-downs.

Micron’s balance sheet remains solid, with ample liquidity to support ongoing investment and weather potential market volatility. Net debt levels are manageable, and the company retains flexibility to pursue strategic initiatives or return capital to shareholders in the future.

This financial resilience reduces downside risk for MU stock and supports the case for long-term ownership rather than purely cyclical trading.

Product Roadmap and Technology Leadership: Why the Future Looks Different This Time

Micron’s product roadmap played a central role in shaping investor sentiment following the earnings release. The company continues to invest heavily in advanced DRAM nodes, next-generation NAND technologies, and specialized memory solutions for AI workloads.

HBM remains the most strategically significant product line. Micron’s ability to scale HBM production while maintaining quality and reliability is a key competitive advantage. With AI workloads expected to grow rapidly over the next decade, HBM could become a core earnings driver rather than a niche offering.

In NAND, Micron emphasized progress in high-layer-count technologies that improve density and reduce cost per bit. These advancements are essential for maintaining competitiveness as storage demand grows across enterprise and consumer applications.

Taken together, these product initiatives suggest that Micron Technology Earnings are becoming increasingly tied to secular growth trends rather than short-term pricing cycles.

Market Expansion and Customer Relationships: Building Long-Term Revenue Visibility

Beyond technology, Micron’s strategy emphasizes deeper partnerships with key customers. Long-term supply agreements, particularly in data center and automotive markets, provide revenue visibility and reduce earnings volatility.

The MU Financial Report indicated that customer engagement around AI-related infrastructure is intensifying. Early involvement in system design allows Micron to tailor memory solutions to specific workloads, strengthening switching costs and customer loyalty.

This approach supports more predictable revenue streams and enhances pricing power, both of which are positive for MU stock price stability over time.

Valuation Implications: Rethinking How MU Stock Should Be Priced

The strong earnings report forces investors to reconsider how Micron Technology stock should be valued. If earnings remain highly cyclical, a low multiple is justified. However, if the company is transitioning toward a more structurally profitable model, the valuation framework must evolve.

Improving margins, stronger free cash flow, disciplined capital allocation, and exposure to AI-driven demand all support the argument for multiple expansion. While MU stock price has already moved higher, it may still undervalue the company’s long-term earnings power if these trends persist.

That said, risks remain. Memory markets are still competitive, and supply discipline must be maintained across the industry. Any return to aggressive capacity expansion could undermine pricing and margins.

MU Stock Price Outlook: Buy or Sell?

Based on the analysis of the MU Financial Report, the recent rally in MU stock appears fundamentally justified rather than purely speculative. The earnings beat was driven by real improvements in business quality, not just short-term pricing fluctuations.

In the near term, MU stock price may experience volatility as investors digest the rally and broader market conditions evolve. However, over a multi-year horizon, the combination of AI exposure, margin expansion, and improved financial discipline supports a constructive outlook.

Investment View:

For long-term investors, Micron Technology stock merits a Buy rating. The company is emerging from the downturn with a stronger business model, better product mix, and clearer growth drivers than in previous cycles. While risks remain, the risk-reward profile appears favorable at current levels.

Final Thoughts: Why This Earnings Report May Be Remembered as a Turning Point

The December earnings release may ultimately be viewed as a defining moment in Micron’s corporate trajectory. Rather than signaling a temporary rebound, the MU Financial Report suggests a deeper transformation underway.

If Micron continues executing on its strategy—maintaining supply discipline, advancing technology leadership, and deepening customer relationships—Micron Technology Earnings could become more stable, more predictable, and more valuable than at any point in the company’s history.

For investors, this shift changes the conversation around MU stock from a cyclical trade to a long-term growth opportunity tied to the expansion of AI, data centers, and intelligent systems worldwide.