In mid-January 2026, former U.S. President Donald Trump intensified public debate over the intersection of artificial intelligence (AI), power infrastructure, and the stock market, proposing an emergency wholesale electricity auction designed to make Big Tech pay directly for the massive energy demands of new AI data centers. This development has added a fresh catalyst for several of Wall Street’s most closely watched shares, including AMZN stock, MSFT stock, GOOGL stock, and META stock, and is helping to reshape investor expectations for capital expenditure, profitability, and long-term strategic positioning across the largest technology companies. Trump’s call for an auction, aimed at forcing technology giants to bid on 15-year contracts to fund up to $15 billion in new generation capacity, mirrors broader political and economic pressure on tech to contribute more transparently to public costs associated with AI-driven infrastructure growth.

At face value, Trump’s proposal is positioned as an attempt to rally industry contributions toward new electricity generation without shifting burdens onto consumers. Yet for capital markets, the deeper implication is a reckoning over how these companies’ insatiable demand for compute and power will be financed and priced. Contrary to the political rhetoric, the largest cloud and AI infrastructure spenders — namely Amazon, Microsoft, Alphabet, Meta, and AI partner OpenAI — are already voluntarily covering significant energy costs and making multi-billion-dollar commitments toward expanding data center capacity. Analysts have emphasized that these corporations “are financially robust” and not capital constrained, despite debates over whether the pace and scale of those investments will be accretive to shareholder returns.

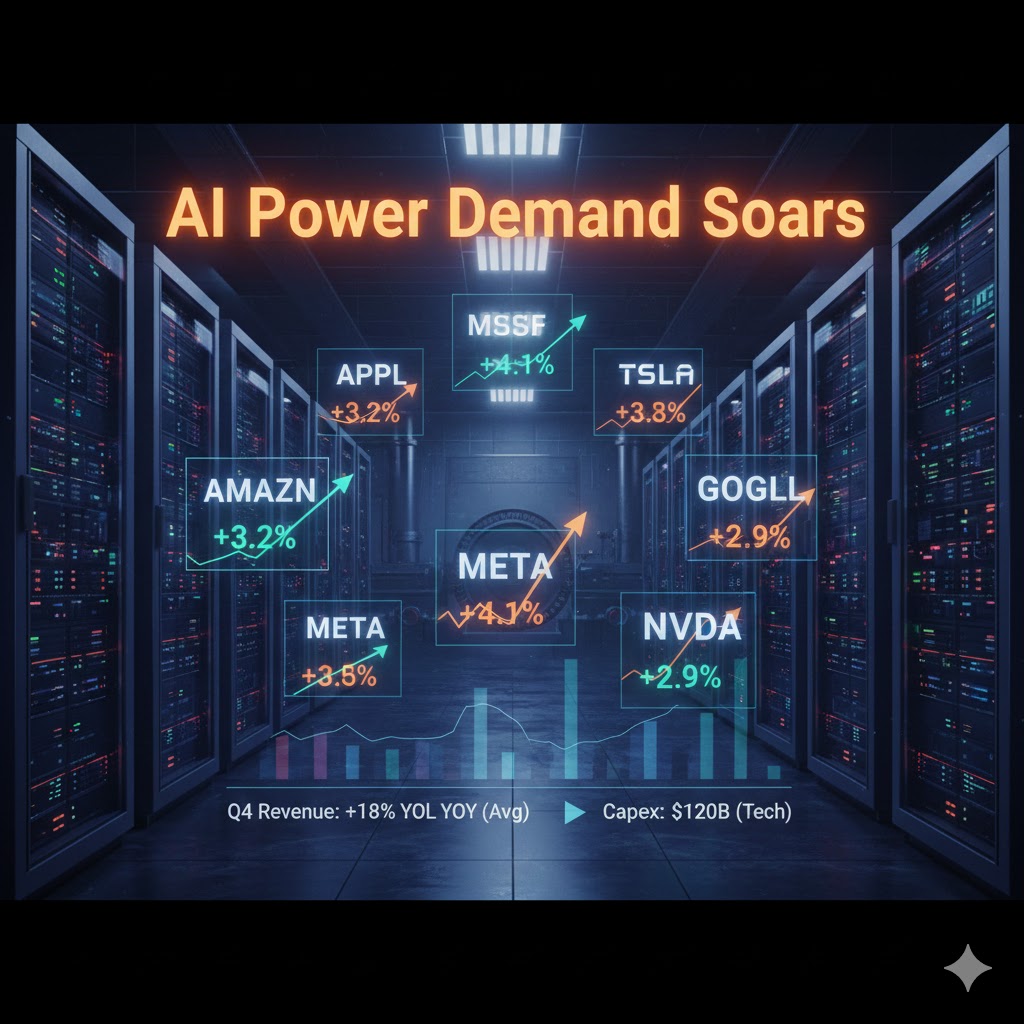

As of January 2026, Amazon.com, Inc. (AMZN) continues to trade near the $230 – $240 range on the NASDAQ, reflecting its ongoing mix of growth and cost discipline challenges. According to recent pricing data, Amazon’s shares were around $239.12. Meanwhile, Microsoft Corporation (MSFT) stocks are trading in the mid-$450s to $460s, with quotes such as $459.86 reported on market trackers. Alphabet Inc. (GOOGL), the parent of Google, crossed important market value thresholds recently, with its Class A shares hovering around $330-$335 and the company breaking above a $4 trillion market cap milestone in early January 2026 amid strong AI partnerships. Meta Platforms, Inc. (META) is quoted variably around low‐to-mid $600s, with data sources reporting levels such as $661.53 to $620.25 depending on the exchange and real-time feed.

These price levels, coming after volatile earnings seasons and heavy capital spending disclosures, underscore how deeply investors are attempting to price both the opportunity and the risk in this AI infrastructure race. The direct financial burden of electricity has become not just a political talking point but a genuine operating cost input for evaluating long-range profitability. Historically, increased AI data center demand has led to aggressive capital expenditure (CapEx) across these tech giants. For example, industry news reveals that Alphabet and Meta have planned or increased multi-hundred-billion-dollar investments in cloud and AI infrastructure, while Microsoft and Amazon each forecast similarly expansive capital budgets aimed at sustaining AI growth.

Capital expenditure patterns offer a key insight into how these companies are positioned relative to market expectations. Across the tech sector, analysts estimate that the combined 2025 CapEx for Alphabet, Amazon, Microsoft, and Meta could exceed hundreds of billions of dollars, a substantial uptick from prior years and far larger than public utilities typically allocate. This surge in infrastructure spending is directly tied to the need for compute power (notably GPUs and custom AI accelerators), network backbone capacity, and power provision for data centers.

For AMZN stock, a material component of its valuation is the performance of Amazon Web Services (AWS), the company’s cloud and AI infrastructure division. AWS has consistently outpaced other segments in revenue growth, even lifting the broader company’s financials when retail margins are compressed. AI-related demand has turbocharged AWS sales; in certain quarters, AWS has reported year-over-year growth rates of around 20 %, a meaningful driver behind analyst optimism. Yet cloud expansion and global data center builds carry significant up-front costs, and the prospect of new electricity pricing frameworks could tighten margins on long-term contracts or shift cost structures, creating new variables for discounted cash flow models used in equity valuation.

The story for MSFT stock is similar, though complicated by Microsoft’s unique exposure through both Azure (its cloud arm) and its partial ownership of OpenAI. Microsoft has publicly committed to “paying its way” in data center electricity costs and has backed this with pledges to fund grid upgrades and assume higher utility rates in regions where its facilities operate. Such initiatives aim to defuse political backlash over rising energy prices while securing operational continuity for Azure’s growth, which remains a core component of Microsoft’s long-term revenue trajectory.

Microsoft’s financial results also reflect unusually large CapEx outlays, often exceeding $50 billion annually in pursuit of AI infrastructure expansion. While this level of investment supports future cloud revenue growth, it also has weighed on free cash flow generation — a key metric for some valuation frameworks. The balance between CapEx and operating cash flows is often a subject of detailed scrutiny by institutional investors when assessing forward P/E ratios and growth sustainability for MSFT stock price modeling.

GOOGL stock, representing Alphabet’s equity, has been one of the stronger performers amid this cycle. Despite previous setbacks related to regulatory concerns and tariff announcements that once drove share prices down to 52-week lows, recent advances – including partnerships integrating Google’s Gemini AI models into broader ecosystems – have driven the stock above milestone valuations, generating meaningful returns for shareholders. Alphabet’s cloud business has also scaled rapidly, contributing a healthy percentage of total revenue and offsetting slower growth in traditional search and ad businesses. Its strategic alignment of AI product deployments and infrastructure build-outs has strengthened investor confidence, helping drive GOOGL stock gains that outpaced many of its peers in late 2025 and into early 2026.

In contrast, META stock performance has been more uneven, reflecting investor skepticism over whether its spending on extended reality, metaverse platforms, and sprawling AI data centers will ultimately translate into sustainable profit streams. Meta’s elevated capital budgets — in some periods hitting triple-digit billions — coincide with questions about monetization levers and cloud service viability. Its lack of a broad third-party cloud customer base, compared with AWS or Azure, means Meta must anchor returns primarily in advertising and end-user AI services, a narrower monetization path for data center investments.

These differences in business models help explain why stock market participants have begun to segment the Magnificent Seven rather than treating them as a monolithic “AI bubble” bet. Investors increasingly differentiate between companies delivering demonstrable, recurring profit growth (like AWS and Google Cloud) versus those burning capital for future payoff that remains speculative from a near-term earnings perspective.

The potential introduction of a power auction mechanism that could set long-term pricing contracts for new energy generation aimed specifically at AI data center loads could have asymmetric effects on each stock’s future earnings outlook. If tech companies are required to pay higher, more stable electricity rates, this might temper some infrastructure operating cost uncertainties and potentially benefit long-term financial planning. Conversely, utilities and independent power producers might see altered demand curves or pricing competitiveness once 15-year technologies and cost assumptions are baked into long-term contracts.

In sum, the interplay between AI-driven infrastructure demand and evolving energy market mechanisms is redefining how major tech stocks are evaluated. AMZN stock, MSFT stock, GOOGL stock, and META stock each face distinct pathways shaped by their balance of cloud adoption, CapEx intensity, and monetization strategies. While broad AI enthusiasm remains a positive thematic driver, the introduction of energy cost frameworks and political scrutiny highlights the importance of rigorous financial modeling focused on growth trajectories, profit margins, and sustainable operating leverage.