The earnings season for the tech giants, the “Mag 7,” will begin on Wednesday, with Microsoft (NASDAQ: MSFT), Meta Platforms (NASDAQ: META), and Tesla (NASDAQ: TSLA) releasing their results after market close, followed by Apple (NASDAQ: AAPL) on Thursday. These four companies have a combined market capitalization of $10.5 trillion. Rich Prvorotsky, head of Goldman Sachs’ Delta One department, recently stated that the core issue this earnings season is clear: “Who is cutting spending, and who is increasing it?”

Market expectations are that the “Mag 7” will see a 20% profit growth in Q4, marking the slowest growth rate since early 2023. Against this backdrop, these companies are under pressure to demonstrate that their significant capital expenditures are yielding returns in a more meaningful way. Investor focus on capital expenditure guidance is at an all-time high, as this data will directly influence the market’s view on the return cycle for AI investments.

This week, a third of the S&P 500 (S&P: .SPX) components (by market cap) will report earnings. According to Bloomberg’s compiled data, nearly 80% of the S&P 500 companies have exceeded analysts’ expectations so far. Ulrike Hoffmann-Burchardi of UBS Global Wealth Management commented, “We expect tech stocks to perform strongly, but we also anticipate earnings growth to extend across various sectors.”

Despite strong earnings, Chris Senyek of Wolfe Research pointed out that stocks of companies exceeding both revenue and profit expectations have shown negative performance after earnings reports. “In other words, double beats are being punished because of solid results,” he said. “We believe this trend will not be sustainable during the earnings season.”

Capital Expenditure Becomes the Core Focus

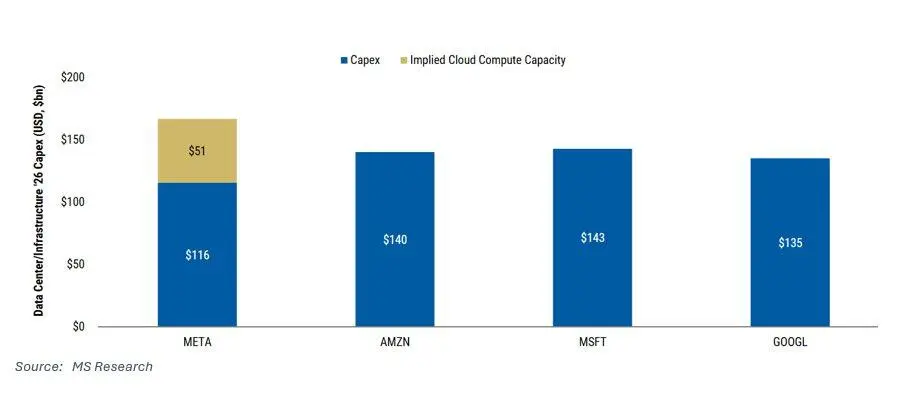

Morgan Stanley’s projections for 2026 capital expenditures indicate that tech giants are undergoing an unprecedented expansion of investments.

Meta Platforms (NASDAQ: META) is expected to announce capital expenditure guidance of approximately $120 billion for 2026, with management previously indicating that 2026 will be “significantly larger” than the $70-$72 billion guidance for 2025. Morgan Stanley analysts noted that Meta’s off-balance-sheet leases, along with those from Google, CoreWeave, and NBIS, represent an additional $50 billion in incremental capital expenditures, bringing the total theoretical amount to $170 billion.

Microsoft (NASDAQ: MSFT) has recently indicated that its capital expenditure growth will accelerate in fiscal year 2026 (ending June), with growth rates expected to surpass the 58% increase in fiscal 2025. Morgan Stanley and market consensus both anticipate spending to exceed $140 billion. Microsoft’s capital expenditure guidance for this quarter indicates a sequential increase, implying a total expenditure above $35 billion.

Google (NASDAQ: GOOGL) is expected to have capital expenditures of around $135 billion for 2026, but due to the growth in its cloud and TPU business, this number could rise to $150 billion. This is a significant increase from the $91-$93 billion guidance for 2025, with management already stating that further increases are expected in 2026.

Amazon (NASDAQ: AMZN) has the least transparency regarding its capital expenditure, as it has not split its AWS infrastructure and retail business. Morgan Stanley forecasts infrastructure capital expenditures to reach $140 billion for 2026, with total capital expenditures at $175 billion, compared to a $125 billion guidance for 2025.

Microsoft: Trapped Between SaaS and OpenAI

Mark Schilsky, an analyst at JPMorgan, highlighted that from an investor’s perspective, Microsoft (NASDAQ: MSFT) is currently “caught between SaaS and OpenAI.” The only way out is to significantly accelerate Azure’s growth to the 40%+ range in the low to mid-tier.

Market expectations are that Microsoft’s Q2 Azure constant currency revenue growth will be around 39%, two percentage points higher than the company’s guidance of 37%. If Azure achieves a 40% growth this quarter, it would be enough to drive the stock price up. For Q3 guidance, investors are hoping for a growth rate of about 38%, suggesting an acceleration in growth.

Schilsky emphasized that the market generally believes OpenAI is losing to Google (NASDAQ: GOOGL) and that OpenAI needs to prove investors wrong by launching GPT-6. Despite the overall subdued sentiment in the SaaS/software sector, investors will focus on companies with accelerating revenue growth.

It’s also worth noting that based on Bloomberg’s consensus 2026 earnings per share estimate, Microsoft (around 26.5x) is valued lower than Google (around 29.5x).

Meta: Investor Sentiment Turns Cautious

Since Meta Platforms’ (NASDAQ: META) Q3 earnings report, investor sentiment has notably soured. During the report, Mark Zuckerberg made it clear that the company would continue significantly increasing operating expenses and capital expenditures. So far, investors have seen little tangible evidence that Meta’s “super-intelligent labs” can produce leading models.

JPMorgan analyst Doug Anmuth stated that investor sentiment is “cautious,” with concerns over 2026 spending/capital expenditures and AI strategy, despite revenue growth continuing to beat expectations. The firm expects 2026 capital expenditures to be $115 billion (a 61% year-over-year increase), with GAAP operating expenses of $153 billion (a 30% year-over-year increase).

The most critical KPI for Q4 is revenue, with investors expecting approximately $60 billion (a 24% year-over-year growth), slightly above the upper range of the $56-$59 billion guidance. For 2026 operating expense guidance, investors generally believe that the street’s estimate of $150 billion (a 28% year-over-year increase) is too low, and expect it to exceed $155 billion.

Investors are looking for some assurance that operating profit will grow year-over-year in 2026. Any flat or slightly declining growth would be unacceptable. Based on recent conversations with investors, most buy-side analysts expect GAAP EPS for 2026/2027 to be around $30/$35, while the street’s consensus is around $30/$33.50.

Tesla: Musk’s Show

Morgan Stanley notes that Tesla (NASDAQ: TSLA) has particularly large variations in its Q4 earnings report and financial KPIs for 2026. Stock price reactions will depend on incremental updates regarding Robotaxi/Cybercab scale-up, unsupervised FSD launch, Optimus Gen 3, and AI5 chip development.

The firm expects 2026 deliveries to be 1.6 million units (a 2.5% year-over-year decline), which is 9% below the market consensus. It forecasts Q4 automotive gross margins (excluding carbon credits) to be 14.2%, below the market consensus of 14.8%. Free cash flow for 2026 is expected to be negative $1.5 billion, while the market consensus is positive $3.1 billion.

Key points of focus include: the public launch timing of Robotaxi in Texas, the unsupervised FSD launch path, the progress of AI5 chip design, and the preliminary release timeline for Optimus Gen 3 robots (previously indicated for February/March 2026). Tesla’s decision to eliminate Robotaxi safety supervisors in Austin may signal that personal unsupervised FSD is about to be launched.

Amazon and Google: Cloud Business Growth is Key

Amazon (NASDAQ: AMZN) remains one of the most frustrating stocks for internet investors. Despite poor performance in recent months (and years), the stock still has crowded long positions. Investors are betting that AWS revenue growth will accelerate significantly, partly due to Anthropic’s continued rapid growth, and that the stock is undervalued, currently at historic lows based on GAAP P/E.

The most important KPI for Q4 is AWS revenue growth. The street expects a 21% year-over-year increase, but most investors anticipate growth in the 22%-23% range, with specific targets of 22.5%-23.0%. Investors expect AWS growth to continue accelerating in Q1 and Q2, with some Amazon bulls believing that AWS revenue growth may approach 30% by year-end.

For Google (NASDAQ: GOOGL), investors expect search revenue to grow 15%-16% year-over-year (including about a 1% favorable impact from foreign exchange rates), higher than the street’s 13.5% expectation. Google Cloud revenue is expected to grow 38%-40% year-over-year, above the street’s expectation of 35%, and it needs to accelerate significantly in Q1.

JPMorgan analyst Schilsky warned that Google is shifting from a “strong stock” to a “lazy long” territory. Buy-side expectations for 2027 EPS have not significantly exceeded street estimates, with investors betting more on continued valuation multiple expansion rather than substantial earnings beats. Notably, Google is currently more expensive than Microsoft, Amazon, and Meta when calculated based on the 2026 GAAP P/E.