The artificial intelligence (AI) boom has “produced” many winners, with the “Big Seven” tech companies benefiting significantly. However, the main players in AI appear to be shifting this year. According to a new report from U.S. investment bank Jefferies, investors’ focus is moving from hyperscale platforms to key component suppliers.

Jefferies analyst Christopher Wood noted in his latest report Greed & Fear that the surge in AI spending over the years has entered a new phase. Pricing power is no longer held by chip designers or cloud platforms but has shifted to memory manufacturers.

In fact, since global memory prices recovered and rose in the first half of 2025, both spot and contract prices have soared. Stock prices of memory giants such as SK Hynix and Micron have increased sharply as a result.

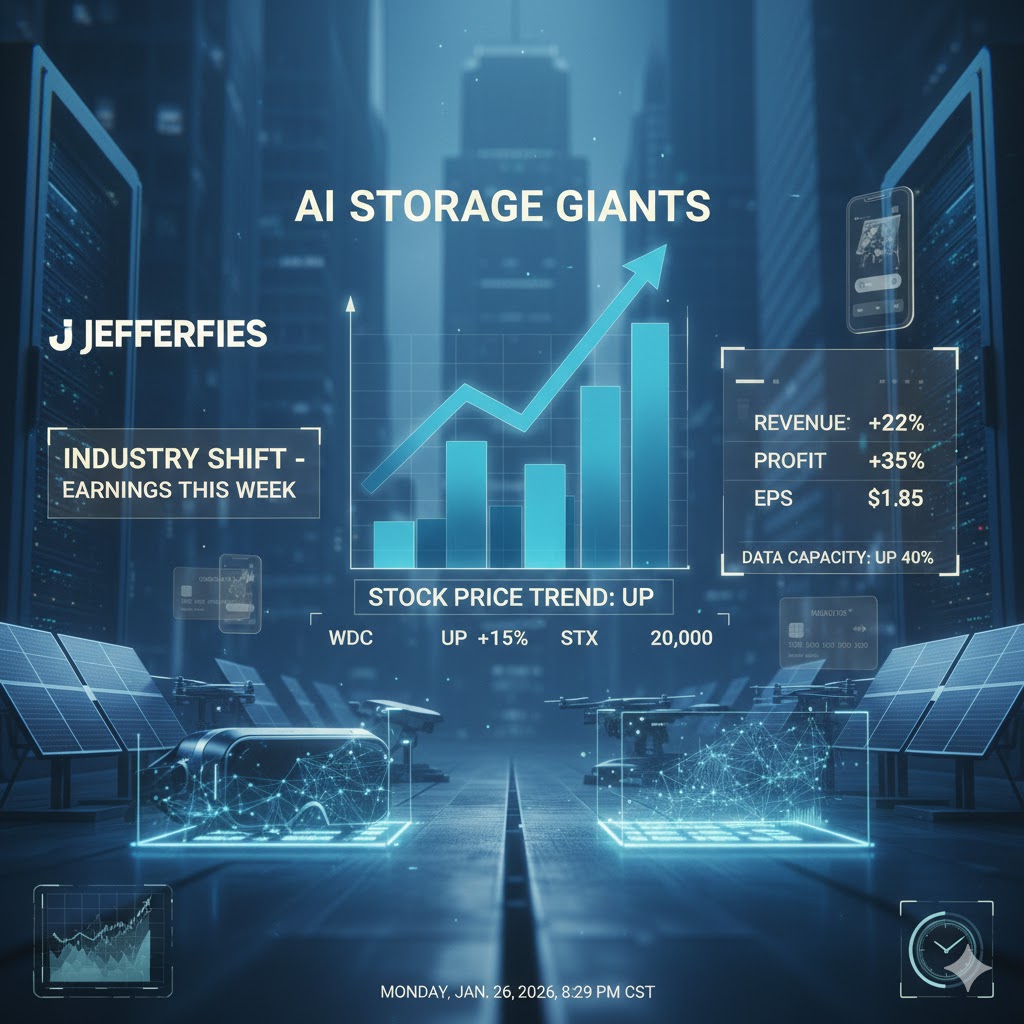

The Jefferies report comes as memory giants are set to release their Q4 2025 earnings this week. Major players including Samsung, SK Hynix, Seagate Technology (NASDAQ:STX), and Western Digital (NASDAQ:WDC) will report quarterly results, providing investors with insights into the storage industry’s outlook through earnings releases and calls.

The market generally expects that the storage “supercycle” driven by the AI boom is likely to continue. According to Counterpoint, memory prices are projected to rise another 50% in Q1 2026.

Diverging Stock Performance

The Jefferies report also highlights an increasing divergence in stock performance. Since late October last year, large hyperscale data centers and AI platform leaders have lagged in stock performance, while memory manufacturers and semiconductor makers have seen significant gains.

Jefferies estimates that memory prices rose about 50% last quarter, further strengthening the bargaining power of suppliers within the AI supply chain.

Of course, this advantage comes with rising costs. New chip fabrication plants now require investments of tens of billions of dollars. Jefferies notes that some memory manufacturers are urging customers to share these costs in exchange for guaranteed supply.

Wood emphasizes that these concerns are already reflected in the stock market. Despite soaring shares of chip makers and memory suppliers, several large cloud computing and internet companies have seen their stock prices decline in recent months, even as their capital expenditure plans have been extended into 2026.

Jefferies expects hyperscale cloud service providers’ capital expenditures to continue growing sharply this year, increasing pressure to generate returns.

“The AI industry landscape remains solid, but industry leadership is shifting. Memory suppliers are likely to be short-term winners, while investors are increasingly cautious about companies investing heavily in AI infrastructure without clear evidence of profitability,” Wood summarized.

When Will the AI Boom Slow?

Overall, while investment in the AI sector continues to grow, Jefferies cautions that the spending cycle is no longer in its early stages.

The report compares the current environment with other capital-intensive industries, where returns often normalize over time.

“The key risk is when investors begin questioning whether AI spending can generate sufficient profits to justify such massive investments,” Wood wrote.