JPMorgan has launched its first valuation model for Waymo, forecasting a significant surge in order volume due to the company’s $16 billion financing and global expansion. Waymo’s order volume is expected to soar from 15 million in 2025 to 277 million in 2030, with a compound annual growth rate (CAGR) of 79%. The company plans to achieve explosive growth by expanding into airports and international markets, capturing a 6% share of the U.S. ride-hailing market by 2030.

JPMorgan’s first-ever valuation model for Waymo suggests that the self-driving company, owned by Alphabet (NASDAQ:GOOGL), will experience explosive growth in the next five years. The bank predicts that Waymo’s annual order volume will rise from 15 million in 2025 to 277 million by 2030, with a CAGR of 79%, and the total bookings will reach approximately $6 billion, capturing around 6% of the U.S. ride-hailing market.

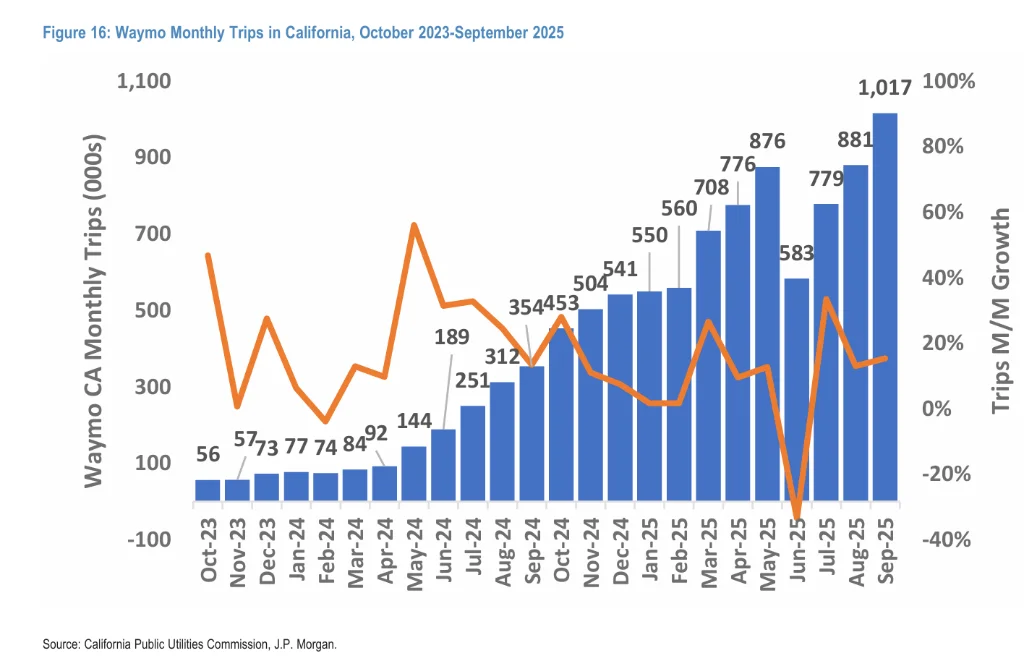

This prediction comes as Waymo has just completed $16 billion in funding, valuing the company at $126 billion, only 15 months after its last $5.6 billion round of funding. Waymo announced that this new capital would allow the company to “move forward at an unprecedented pace.” During this period, Waymo’s weekly paid orders have grown nearly threefold from 150,000 to more than 400,000, with the company set to complete 15 million orders in 2025.

JPMorgan analyst Doug Anmuth, in a report released on February 3, projected that Waymo’s fleet will expand from fewer than 3,000 vehicles at the end of 2025 to over 35,000 vehicles by the end of 2030, a 67% annual growth rate. By 2026, Waymo’s fleet is expected to double to about 5,725 vehicles, providing over 35 million orders, generating more than $800 million in total bookings.

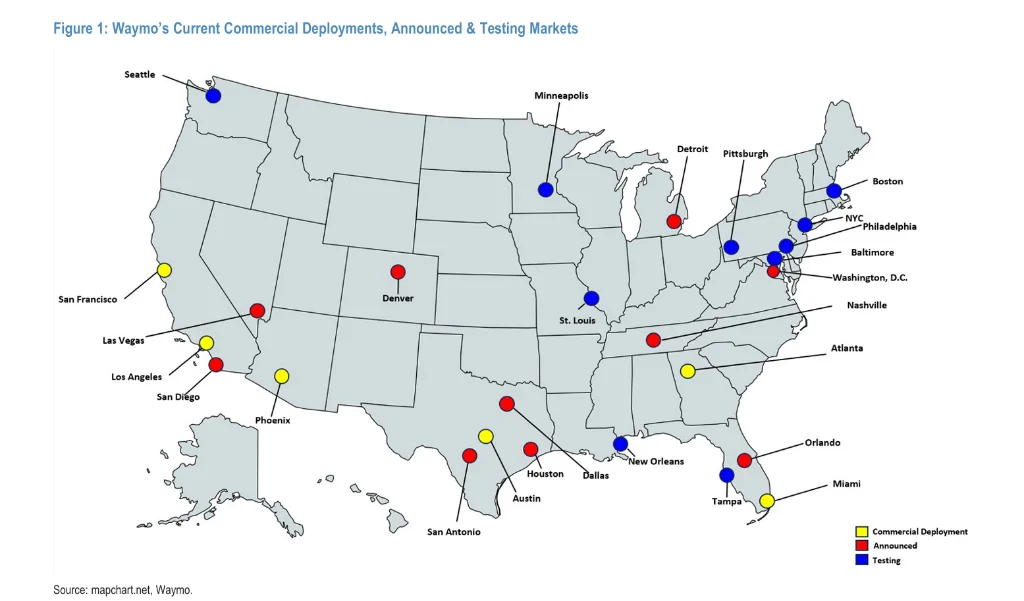

The bank believes that autonomous driving will expand the overall market size, with most of Waymo’s growth coming from incremental markets, but it will also capture some market share from traditional ride-hailing platforms like Uber and Lyft. Currently, Waymo operates in six markets, including Phoenix, San Francisco, and Los Angeles, and plans to expand to 10 more U.S. cities by 2026, with plans to enter London and Tokyo.

Aggressive Expansion Plans Underpin High Growth Expectations

JPMorgan’s valuation model is based on Waymo’s city expansion plans and fleet growth trajectory. The bank expects Waymo to enter 10 new U.S. cities by 2026, including Dallas, Houston, San Antonio, and Orlando, and launch operations in London and potentially Tokyo, bringing the total number of operational and testing cities to over 20.

Specifically, JPMorgan estimates that Waymo’s Q4 2026 order volume will reach approximately 11.6 million, equivalent to a weekly operating pace of around 900,000 orders. This is close to Waymo’s own target of reaching 1 million orders per week by the end of 2026.

In terms of market share, JPMorgan forecasts that Waymo will account for about 1% of the U.S. ride-hailing market’s order volume and total bookings by 2026, with this share rising to 6% by 2030. However, the bank emphasized that autonomous driving technology will serve as a market expansion tool, meaning Waymo’s success will help grow the overall market rather than just take market share from existing players.

$16 Billion Financing Accelerates Commercialization Deployment

Waymo announced on February 2 that it had completed $16 billion in financing, with major investors including Alphabet, Dragoneer, DST Global, Sequoia Capital, and other institutions. This follows a $5.6 billion funding round in October 2024, just 15 months prior.

During this period, Waymo’s operational data has risen rapidly. The company’s weekly paid orders have grown from 150,000 to more than 400,000, and the 15 million orders expected for 2025 are three times more than in 2024. Reports indicate that by December 2025, Waymo had reached a weekly operating pace of 450,000 orders, an 80% increase from April 2025’s 250,000 orders.

Waymo stated that it will use this new funding to “advance at an unprecedented pace” in its global expansion, aiming to achieve more than 1 million orders per week by the end of 2026, roughly 2.5 times the current pace of 400,000 orders. The company is building out ride-hailing infrastructure in over 20 cities, including Tokyo and London.

JPMorgan noted that this large financing round will support Waymo in rapidly expanding its fleet in the short term, ensuring the company can meet its fleet targets of 5,725 vehicles by the end of 2026 and 35,275 vehicles by 2030. This will represent approximately 13 times the size of the current fleet.

Airports and Highways as Key Breakthrough Points

Waymo has recently made significant progress in gaining access to airports. Last week, Waymo announced the launch of commercial operations at San Francisco International Airport (SFO), initially opening to a select group of users, with plans to expand to all users in the coming months. This is strategically timed ahead of the Super Bowl on February 8 and in preparation for the FIFA World Cup from June to July, with six matches to be held in Santa Clara.

Previously, Waymo had already begun operations at San Jose Airport and received permission to test at Newark Airport. The company has also started employee testing at Dallas Love Field and San Antonio International airports. In December 2025, Waymo disclosed that its cumulative order volume at Phoenix and San Jose airports had exceeded 500,000 orders.

JPMorgan estimates that airport orders account for about 15% of Uber’s total ride-hailing bookings and have higher profit margins. Waymo’s broader access to airports and highways could, in the medium term, impact Uber’s total ride-hailing bookings and EBITDA. However, the bank also noted that autonomous driving could overall expand the available market.

Operational Data Shows Growth, But Retention Still Needs Improvement

According to Sensor Tower data, Waymo One’s monthly active users (MAUs) in January 2026 grew 63% year-over-year, representing about 6.0% of Lyft’s U.S. MAUs and 3.3% of Uber’s U.S. MAUs. In terms of downloads, Waymo One is about 25% of Lyft’s and 34% of Uber’s.

However, in terms of user engagement metrics, Waymo is still lagging behind traditional ride-hailing apps. The Daily Active Users/Monthly Active Users (DAU/MAU) ratio for Uber is 11%, for Lyft it’s 12%, while Waymo One is just 8%. Retention rates indicate that Waymo One’s retention is lower than Uber and Lyft at all time points, possibly suggesting a trend of occasional or tourism-related use.

Google search trends indicate that in Waymo’s five operational markets, search interest has surpassed Lyft’s in Phoenix, San Francisco, and Austin, while it remains slightly below Lyft in Los Angeles and Atlanta. Notably, in Las Vegas, Zoox, which began public operations in September, has also surpassed Lyft in search interest, despite its very limited operational area.

According to Bloomberg Second Measure data, Waymo’s sales in Q4 2025 grew 134% year-over-year, up from 117% in Q3, but the month-over-month growth rate slowed in the fourth quarter, with December seeing only a 2% increase. This data excludes orders booked through Uber’s app in Austin and Atlanta.