In Wednesday’s market session, the sell-off in software stocks and other sectors perceived to be at risk from artificial intelligence continued unabated. JPMorgan believes that investor pessimism is growing increasingly intense.

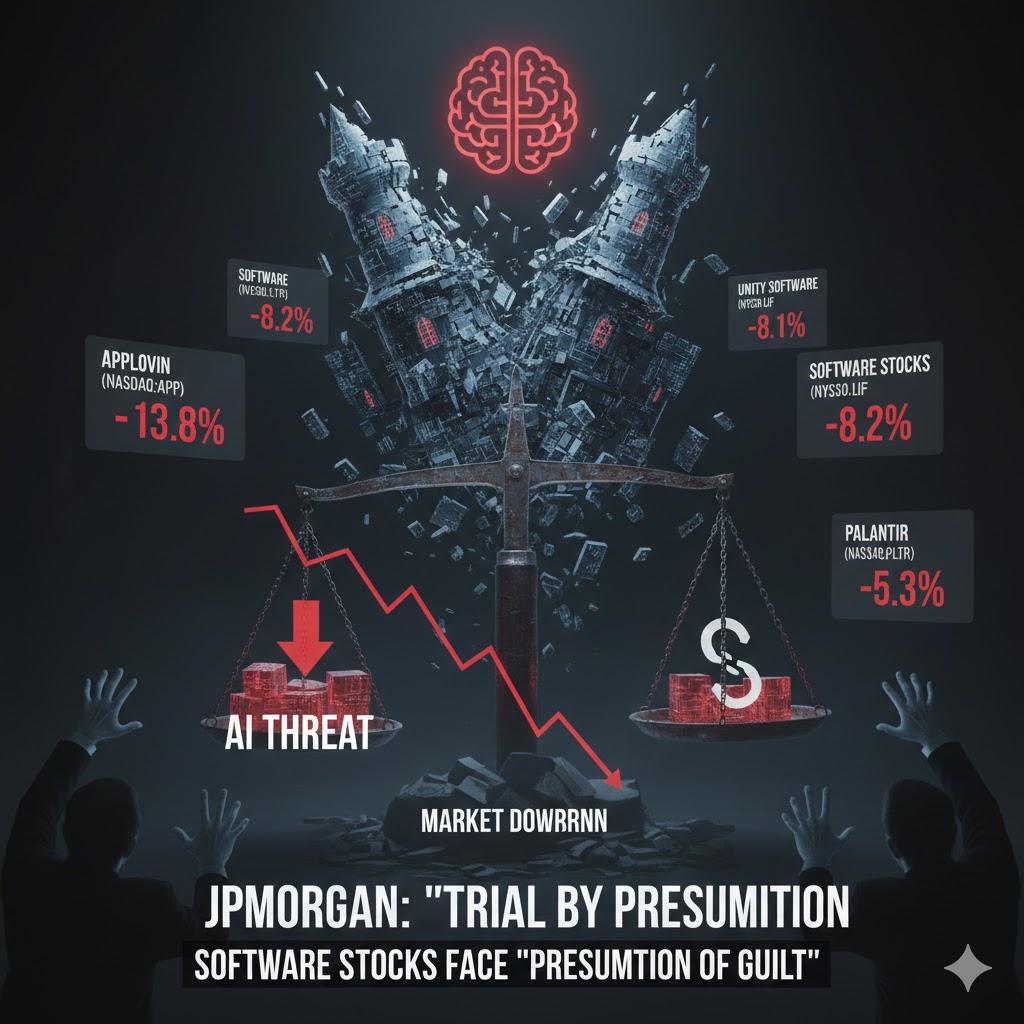

JPMorgan analyst Toby Ogg stated, “The current market environment is not only one of ‘guilty until proven innocent,’ but the software industry is even facing ‘trial by presumption.’”

Today, U.S. AI application software stocks were hit hard again, with Applovin (NASDAQ:APP) falling nearly 14%, Unity Software (NYSE:U) and Life360 (NASDAQ:LIF) dropping more than 8%, and Palantir (NYSE:PLTR) declining over 5%.

Over the past two weeks, Ogg has met with more than 50 investors across Europe and the U.S. He found that these investors have significantly reduced their holdings in software stocks over the past 12 to 18 months. In a client report, he noted that, even after the recent pullback, investors’ willingness to enter the market remains low.

This statement comes after the dramatic declines in the software, financial services, and asset management sectors on Tuesday. The panic was triggered by the release of a new AI automation tool by Anthropic, which raised concerns among investors that many businesses’ operations are increasingly threatened by generative AI.

For software companies, Ogg believes that merely exceeding expectations is no longer enough to convince the market. Unless these companies can undeniably prove that AI is a continuing driver of growth rather than a long-term obstacle, they will struggle to win over investors.

For software companies, overcoming this hurdle is particularly difficult because investors’ concerns are multifaceted. One of the major worries is the account-based pricing model. If AI tools reduce the number of accounts required, this pricing model could be undermined.

Additionally, if software companies use their own AI tools to transform their products, their existing revenue models may be at risk of disruption. Ogg pointed out that any new products released by leading AI platforms (such as the new legal services tool launched by Anthropic) will only heighten the market’s concerns about the sector.