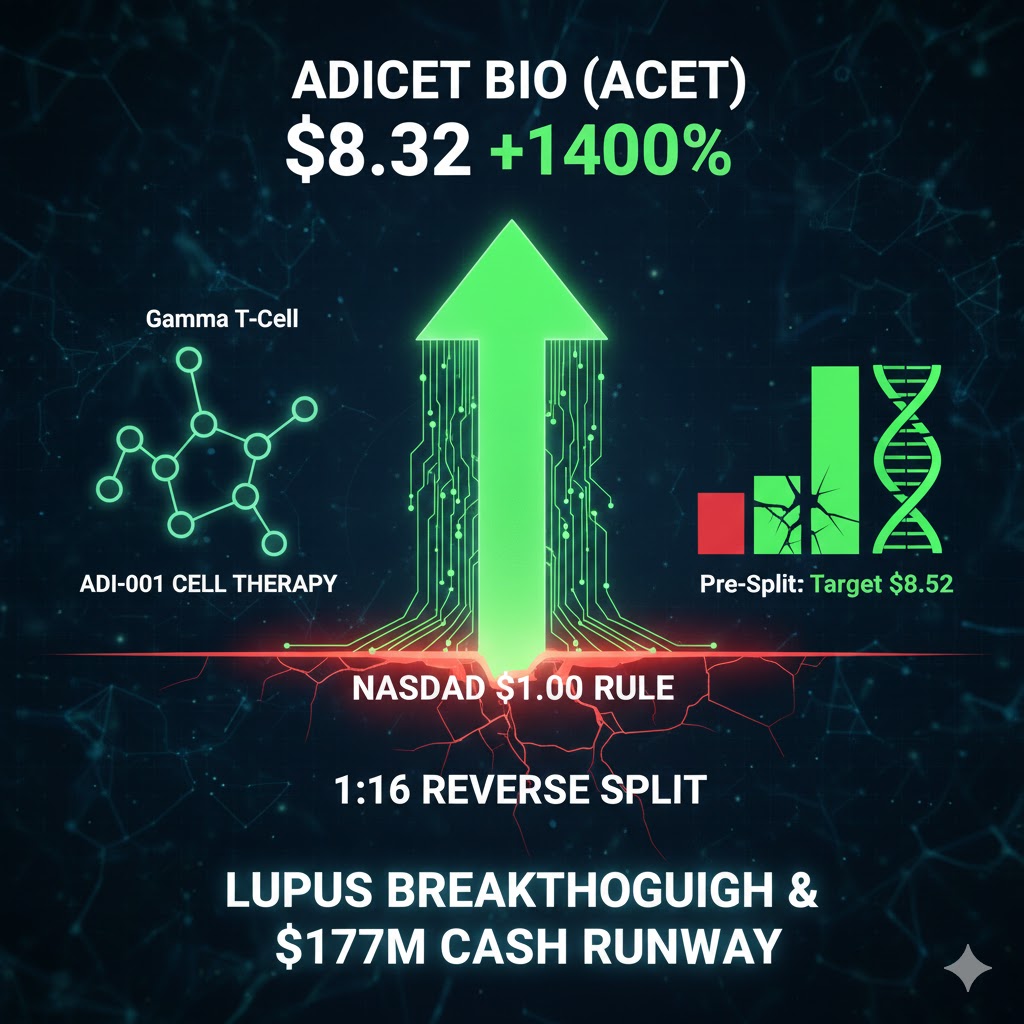

The biotechnology sector is famously known for its high-stakes volatility, where a single clinical readout or a strategic boardroom shift can send valuations into the stratosphere or down to the basement. On Friday, December 26, 2025, Adicet Bio, Inc. (NASDAQ: ACET) became the latest focal point of this intensity. The company officially announced that its board of directors has authorized a 1-for-16 reverse stock split, effective as of 12:01 a.m. Eastern Time on December 30, 2025.

While the headline—a stock trading at roughly $0.52—often triggers immediate skepticism, a deeper forensic analysis of Adicet’s underlying science, its robust cash position, and the unanimous bullishness of Wall Street analysts suggests that this mechanical adjustment might be the final clearing event before a massive re-rating. Is Adicet Bio a falling knife or a coiled spring? For the discerning investor, the data points toward a compelling, high-reward “Buy” opportunity hidden in plain sight.

The Reverse Split Mechanics: Navigating the Nasdaq Floor

The move to implement a 1-for-16 reverse split is, first and foremost, a regulatory necessity. Under Nasdaq’s Listing Rule 5550(a)(2), companies must maintain a minimum bid price of at least $1.00 per share. Adicet, like many clinical-stage biotechs in a challenging capital environment, has spent much of the latter half of 2025 hovering between $0.45 and $0.65. By consolidating sixteen shares into one, the company will artificially boost its share price to approximately $8.32 (based on current levels), thereby regaining compliance and satisfying institutional mandates that often prohibit holding stocks priced under $5.00.

Crucially, the split reduces the outstanding share count from 153.3 million to approximately 9.6 million, but it does not change the authorized share count of 300 million. This creates a significant “overhang” of available shares that the company can use for future financing. While this potential for future dilution is a risk, the immediate effect is a “cleanup” of the capital structure, which often precedes a major influx of institutional capital from funds that were previously sidelined by the penny-stock designation.

The Science of Survival: ADI-001 and the Lupus Revolution

If Adicet Bio were merely a struggling oncology firm, a reverse split would be a red flag. However, Adicet is currently pioneering a potentially revolutionary treatment for autoimmune diseases through its ADI-001 program. ADI-001 is an allogeneic gamma delta ($\gamma\delta$) T cell therapy, a unique class of “off-the-shelf” cells that offer several advantages over traditional CAR-T therapies, including lower toxicity and easier scalability.

The clinical data released in late 2025 has been nothing short of spectacular. As of the August 31, 2025, data cut-off, 100% of patients in the Lupus Nephritis (LN) cohort achieved a renal response. Even more impressively, 60% of those patients achieved a complete response and DORIS (Definition Of Remission In Systemic lupus erythematosus) remission. In a field where current standards of care often fail to provide durable relief, a cell therapy that can effectively “reset” the immune system is a multibillion-dollar asset.

Furthermore, the safety profile remains pristine. In its Phase 1 trials, ADI-001 showed no reported cases of immune effector cell-associated neurotoxicity syndrome (ICANS) and no Grade 2 or higher cytokine release syndrome (CRS). This safety profile is critical because it potentially allows for dosing in an outpatient setting—a major competitive advantage that could dramatically increase market penetration compared to inpatient-only CAR-T treatments.

Financial Health: The Paradox of Cash and Burn

One of the most frequent traps for biotech investors is the “cash cliff.” However, Adicet Bio has managed its balance sheet with surgical precision. In October 2025, the company successfully raised $74.8 million through a registered direct offering. As of September 30, 2025, the company reported a cash and short-term investment position of $103.1 million, which, when combined with the October proceeds, gives the company a cash runway extending well into the second half of 2027.

This is a vital distinction. Unlike many small-cap biotechs undergoing reverse splits to avoid immediate bankruptcy, Adicet is doing so while possessing enough capital to fund its operations for nearly two more years. This runway covers the anticipated 2026 pivotal trial initiations in Lupus Nephritis and potentially other autoimmune indications like Systemic Sclerosis (SSc). From a valuation perspective, Adicet’s market capitalization of approximately $84 million is trading at nearly its net cash value, essentially assigning a value of zero to its entire $\gamma\delta$ T cell platform.

Valuation: Analyst Optimism vs. Market Skepticism

The disconnect between Adicet’s stock price and professional analyst valuations is staggering. As of late December 2025, the consensus rating among analysts remains a “Moderate Buy.” The average 12-month price target stands at $7.17 to $7.75 (pre-split basis), which represents a potential upside of over 1,400% from current levels.

Major institutional firms have recently updated their outlooks:

- HC Wainwright raised its price target from $4.00 to $9.00 in November, citing the robust clinical profile of ADI-001.

- Guggenheim reiterated its “Buy” rating, emphasizing the company’s first-mover advantage in the $\gamma\delta$ CAR-T space for autoimmune diseases.

- Morgan Stanley and BTIG maintain positive stances, focusing on the de-risked nature of the safety profile.

Even on a Price-to-Book (P/B) basis, Adicet appears undervalued at 0.8x, compared to a US Biotech industry average of 2.7x. This suggests that even if the clinical trials only achieve moderate success, the current price offers a significant margin of safety.

The Bear Case: Why the Market is Hesitant

If the data is so good, why is the stock trading at $0.50? The market is currently pricing in three primary risks:

- Dilution Overhang: The authorized share count remains at 300 million, giving the board the ability to issue hundreds of millions of new shares post-split. Investors are understandably wary that the “cleanup” is a precursor to a massive dilutive event.

- Phase 3 Execution Risk: Moving from Phase 1 to a pivotal Phase 3 study involves significant execution risk. While the safety data is strong, the “immune reset” must prove durable over years, not months.

- Competition: The “Off-the-Shelf” cell therapy space is becoming crowded. Competitors like Fate Therapeutics and Nkarta are also vying for dominance, although Adicet’s focus on $\gamma\delta$ T cells provides a unique niche.

Strategic Outlook: The 2026 Roadmap

The reverse split on December 30 will act as a reset button. Once the stock begins trading on a split-adjusted basis above $8.00, it becomes “investable” for a wider array of institutional funds and ETFs. Looking ahead to the first half of 2026, the company is expected to provide clinical updates in Systemic Lupus Erythematosus (SLE) and Lupus Nephritis (LN), as well as align with the FDA on a pivotal study design.

Any positive regulatory update or the initiation of a pivotal Phase 3 trial would likely act as the catalyst that bridges the gap between the current $84 million valuation and the $500 million+ valuation typical of late-stage autoimmune biotechs.

Final Verdict: A High-Conviction Buy for Risk-Tolerant Portfolios

Is Adicet Bio’s valuation too high or too low? Based on a cash-adjusted enterprise value and the strength of its Phase 1 data, the valuation is exceptionally low.

Adicet Bio is a classic “asymmetric” bet. The reverse split is a mechanical hurdle, not a fundamental failure. With a cash runway into 2027, a safety profile that could enable outpatient dosing, and 100% renal response rates in its target population, the company is fundamentally stronger than its stock price suggests.

For investors who can look past the noise of the reverse split, Adicet Bio offers a rare chance to buy into the next frontier of autoimmune therapy at a price that essentially values the technology at zero. The Friday dip following the announcement is likely the final “exhaustion” point before the 2026 catalyst cycle begins.

Recommendation: BUY.

Key Metrics (Estimated December 27, 2025)

- Symbol: ACET (Nasdaq)

- Pre-Split Price: ~$0.52

- Post-Split Price (Dec 30): ~$8.32

- Market Cap: ~$83.96M

- Cash Position: ~$177M (Pro-forma including Oct 2025 raise)

- Analyst Upside Potential: >1,400% (Pre-split basis)